What is the Expense Management Process?

Expenses are an unchangeable fact for every organization or business, and for enterprises and small businesses alike, expense management is an important operations process.

Expense management refers to a set of procedures that allow businesses to monitor and optimize (minimize) their spending—and raise their profit margin. This process encompasses the expense approval workflow in which employees submit expenses they have incurred for reimbursement.

A robust expense approval process helps to ensure that the organization’s spending doesn’t exceed its means. An automated digital expense approval process not only allows you to streamline approvals and save time but also arms you with data that can be used to gain critical insights that can be used to reduce costs.

On the other hand, managing your expense approval process manually (using emails, spreadsheets, and paper invoices and receipts) takes a lot of time and can result in late payments, which can ruin your organization’s reputation among suppliers and impact your timelines if materials you needed are not procured on time. Paper and manual data entry also result in frequent errors and even missing documents that your finance team has to spend precious hours hunting down.

How to Fine-tune Your Expense Approval Process

In a typical expense approval process, each employee sends the finance department a spreadsheet detailing their expenses, accompanied by a folder full of scanned, photographed, and emailed receipts.

A finance professional must then manually reconcile the receipts against the spreadsheet and approve or deny the claim, process payment (or adjust the employee’s next paycheck accordingly) and create a record of the claim and payment. This takes a lot of time and effort, particularly when employees attempt to claim reimbursement for expenditure that doesn’t align with the company’s expense policy, in which case the finance department has to selectively approve and deny individual items.

An automated expense approval workflow can streamline this process by implementing business rules so that claims are automatically approved or denied and routed to the next phase of the workflow. For instance, if an employee submits a claim for an expense that doesn’t meet the business’s requirements, it is automatically returned to them with a comment asking them to alter their claim or provide additional documentation. Similarly, if a claim exceeds a predetermined amount, the claim might be routed to a higher level manager for approval before being routed to finance for reimbursement approval.

Here are a few of the hallmarks of a good expense approval automation software:

- Easy-to-use and set up: If you need to be a developer or an accountant to use the software, only developers and accountants will use it. You want a tool that’s easy to set up and even easier to use on a day-to-day basis.

- Scalable: Your expense automation tool needs to be able to grow with your organization.

- Third-party integrations: Make sure that your workflow automation software supports integrations so that you can connect any existing or future software your accounting team uses without complications.

- Custom workflows: Some automation programs come with preset workflows. Make sure you choose one that offers you the flexibility to fully customize your workflow to meet your organization’s unique requirements.

Why Automate Your Expense Approval Process?

- The average expense report takes 20 minutes to process.

- One in five expense reports are filed incorrectly.

- Two-thirds of employees have not read their organization’s expense claims policy.

- Expense fraud costs US companies $2.8 billion per year.

- Sixty percent of UK employees have failed to claim reimbursement for expenses.

Automating your expense approval process reduces manual data entry and frees up your finance team to do more meaningful work. It may seem like a small thing, but for finance professionals, this can be the difference between daily frustration and job satisfaction—and it can even be a differentiator in the recruitment process when trying to attract top talent.

Making the expense process more intuitive and less administration-heavy also makes the process much easier for your other employees to navigate, which is an important consideration considering the fact that 60% of UK employees say they have failed to file expense reports in the past and 48% of employees spend their own money on business costs without reimbursement.

Aside from the obvious benefits of saving time and effort (and money!), here are some of the advantages of using frevvo to automate your expense approval workflow:

- You’ll get exactly the look & feel and workflow that suits your business needs. No need to shoehorn your operations to fit the software.

- All calculations are performed automatically, massively reducing the incidence of errors.

- Expenses are categorized automatically, making the finance controller’s job much easier.

- Employee information fields are populated automatically.

- It’s easy to attach receipts (including photographs taken with a smartphone).

- The report can be originated and signed on mobile devices.

- The form automatically validates fields and flags errors.

- Automated routing means no more mile-long email threads.

- Automated reminders keep the process flowing = no more bottlenecks and follow-ups!

- A built-in audit trail makes tax season a breeze.

- Rich data gives visibility into the company’s financial health and improves strategic capabilities.

Sound good? Let’s take a closer look at how to reap all these benefits.

How to Implement an Automated Expense Approval System in 3 Easy Steps with frevvo

With frevvo, you can make your expense approval workflow effortless with thoughtful automation. While the word “automation” might have you shaking your head, thinking you don’t have the I.T. resources for that, fear not! frevvo’s software is 100% visual and doesn’t require any coding knowledge.

Here’s how it’s done.

1. Create Your Expense Report Form

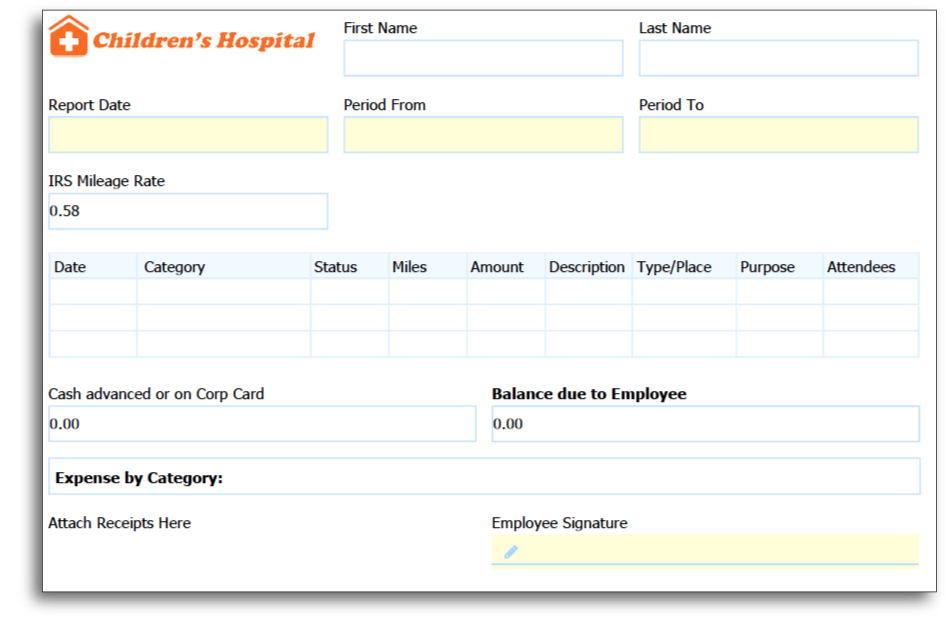

Start by creating your expense approval form. You can kickstart your expense approval automation with a template, which you can fully customize to meet your organization’s unique needs.

Or, you can start on a fresh page and use frevvo’s fully visual drag-and-drop form builder to build the perfect expense report for your business. You can easily enable electronic signatures and attachments, allowing employees to upload smartphone photos of receipts. You can also configure rules to ensure that only accurately completed reports are submitted.

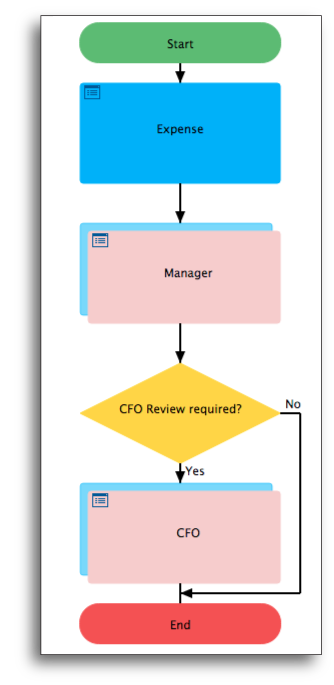

2. Design Your Expense Approval Workflow

Once you have your fully mobile responsive form in place, the next step is to build your expense approval workflow to automatically route the expense claim from one stage to the next. You can apply conditional rules, for instance, sending the form to the CFO to sign off in the event that expenses exceed a threshold amount.

3. Introduce Your New Expense Approval Workflow to Employees

Like any expense approval process, an automated expense approval process only works if everyone uses it and if they use it correctly. Take time to introduce your new system to your staff and show them how to use it.

Once they see how easy it is to use frevvo, even your most admin-averse employees will gladly use the new digital workflow when it comes to submitting expense claims. Your finance department will thank you for making their lives so much easier.

That’s it!

Once you’ve set things up, here’s what happens in your new, automated expense approval process:

- Employee submits expense report – The employee completes the digital form electronically on any device and simply attaches their receipts as PDFs or photographs.

- Automatic routing – The workflow does its job, routing the expense report to the appropriate person. Notifications, reminders, and escalations occur automatically so manual phone calls are eliminated. With a built-in audit trail, anyone can view the current state of the workflow online, so there’s no need to check up on the status of the claim.

- Assess claim – The employee’s supervisor approves, queries or rejects the claim online, never needing to print the form. They can even approve expense claims on their mobile devices with ease, so being out of office no longer needs to cause bottlenecks.

- Process reimbursement – Only once it has been approved is the expense report routed to the financial controller to process the reimbursement.

- Bookkeeping – Finally, the expense claim is documented in the organization’s books. With frevvo’s database and business system connectors, this step can also be automated by linking the expense forms to your SQL database or accounting system.

Ready to start automating your expense approval workflow?

Why not try frevvo’s expense approval software free of charge for 30 days? Get set up in minutes.