If employees frequently travel for work, they’ll need to submit expense reports to receive a reimbursement and comply with travel policies.

Keeping track of expenses that employees incur is vital to managing your cash flow. It also allows you to properly reimburse your employees for any expenses they make.

But any missteps in this process could lead to problems — inaccurate claims, unclear policies, and even fraud are common expense reporting issues that organizations face.

So how can you streamline the expense reporting process and make it easier for employees to receive reimbursement? How can you reduce errors and prevent expense reimbursement fraud?

Start by implementing an expense automation system.

In this article, we’ll take an in-depth look at the automation process for expense reporting, including how it works and its benefits. We’ll also look at how you can automate the expense approval process.

Click the link below to navigate to the section you want to learn more about:

What is Expense Automation?

Expense automation is the use of software to automate submitting, approving, and recording expense reports. This lets you replace paper and eliminate the tedious use of spreadsheets to file claims.

Expense automation helps organizations accurately track expenses and maintain compliance with policies. It also allows you to reimburse employees promptly.

If your employees often travel for work, you’ll want to have a system in place to manage all expenses they’ve incurred.

But travel isn’t the only opportunity for automating your expenses.

Any scenario that involves having to capture, report, and reimburse expenses has the potential to be automated. Some examples include paying out employees for leave and reimbursing business expenses bought on a personal card.

Common types of employee expenses include:

- Transportation

- Lodging

- Meals

- Education/training

- Equipment and supplies

- Phone and internet

- Postage and delivery

Employees may also incur ad-hoc expenses — expenses that aren’t planned for, but are reasonably incurred while doing business. For example, an employee may decide to overnight a shipment to a client.

Every company has different expense policies. But keeping track of all reimbursable expenses is important to manage costs and keep budgets under control.

Let’s look at why you should implement an expense automation solution.

Why Automate Expense Reporting?

Manual processes can undoubtedly get the job done. But they’re more time-consuming and prone to errors. Here’s how your organization can benefit by automating expense reporting.

Speeds Up Reimbursement

Manual expense reporting bogs down your employees with stacks of paperwork. A manual expense reporting process might look like the following:

- An employee gathers their paper receipts

- They fill out an expense report and submit it to their manager

- The manager reviews the report and checks for out-of-policy items

- The report is sent over to the accounting team

- All expenses are entered into the accounting system

- The payment is authorized and reimbursed to the employee

Performing each step of the expense manually means that the entire process can take weeks or even longer. That doesn’t even factor in the additional time to correct any mistakes. A manager will need to send an expense claim back if it contains items that aren’t covered.

With an expense automation system in place, your employees can take photos of their receipts and attach them to an expense report. You can also create automated workflows that handle all the document routing.

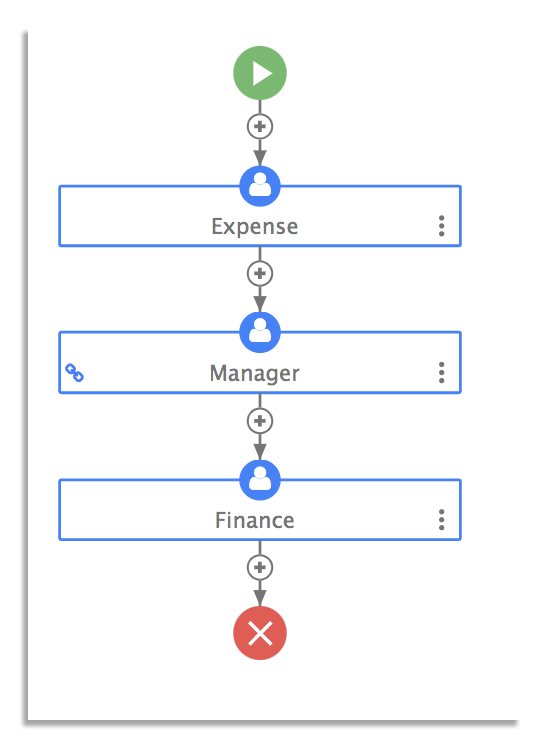

Here’s an example of an automated workflow for expense reports:

Submitted expense reports automatically route to a manager for review and then route to the finance team for final approval and processing.

Eliminating the time-consuming aspects of printing out forms, attaching paper receipts, and chasing approvals can drastically speed up reimbursements. Employees don’t have to wait weeks to be reimbursed for work-related expenses they incur.

Improves Policy Compliance

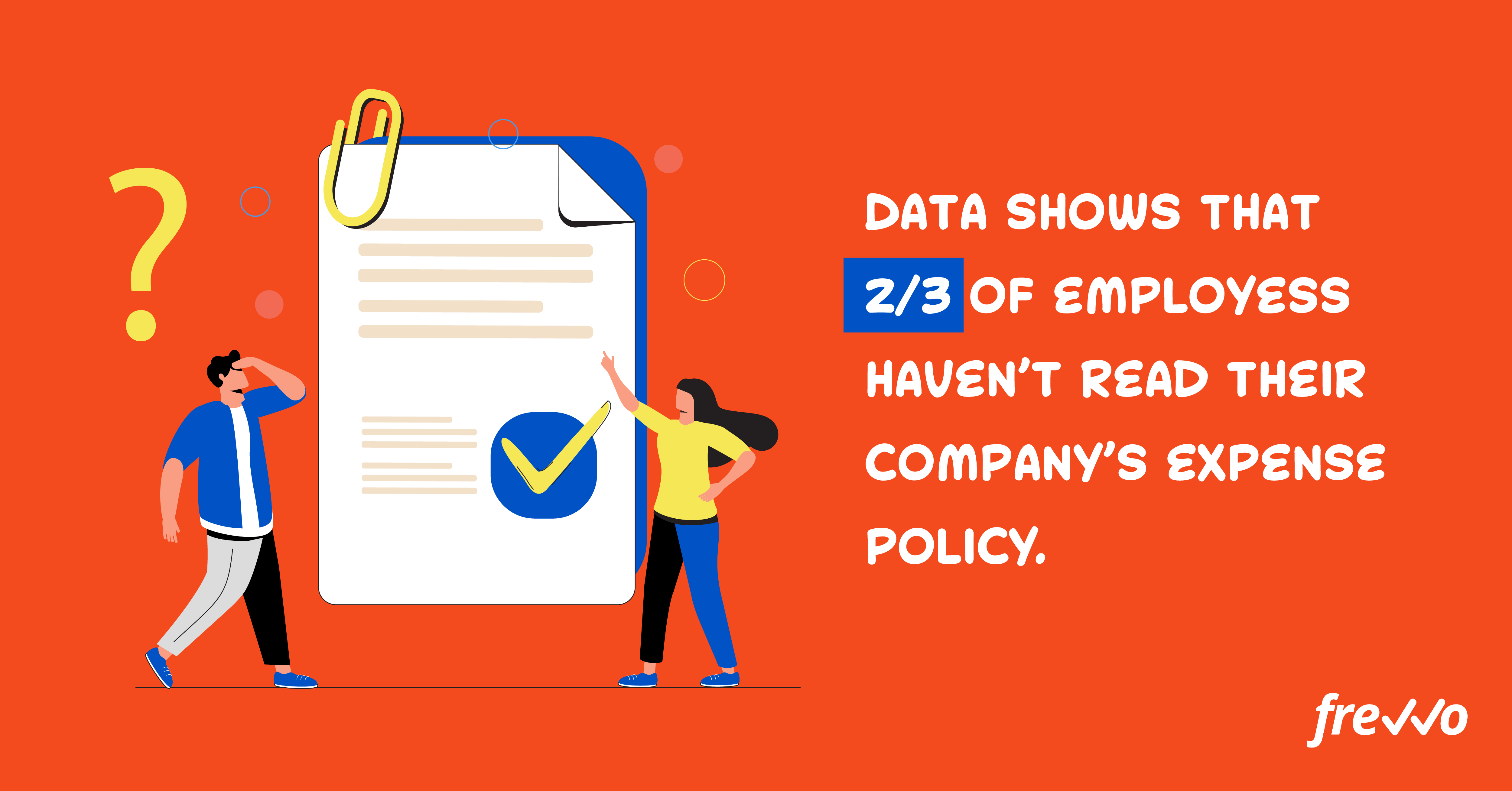

Having a clear policy for travel and expenses is crucial to ensuring compliance. It describes in detail what employees are entitled to, including what items are covered and what aren’t.

But ensuring compliance with expense policies isn’t always easy. Data shows that two-thirds of employees haven’t even read their company’s expense policy.

That means you’ll have many employees submitting expense reports that likely contain out-of-policy items. Some of those expenses will likely slip through the cracks if the finance team is reviewing each item manually.

Communicating your expense policy and using expense automation software can improve compliance. For example, you can list out-of-policy items and even include a checkbox that asks employees to confirm that they’ve read the company’s travel policy.

Prevents Expense Fraud

Expense fraud occurs when employees deliberately make inaccurate or false expense claims. It represents 14% of occupational fraud in an organization with a median loss of $33,000.

The most common types of expense fraud are:

- Mischaracterized expenses: An employee requests reimbursement for non-business expenses. An example is an employee seeking reimbursement for a family meal or personal travel expenses.

- Overstated expenses: An employee claims a legitimate expense is higher than it actually is (e.g., an employee pays $50 for office supplies, but writes it as $100 on their expense report).

- Fictitious expenses: An employee submits a fake paper receipt for a business expense that appears genuine. Another instance is an employee taking receipts from a friend or family member and claiming those expenses.

- Multiple reimbursements: An employee submits the same paper receipt multiple times, meaning the accounting department may approve duplicate payments.

These instances of fraud can have a negative impact on your company’s bottom line. This is assuming you detect them in the first place as expense fraud isn’t always easy to catch.

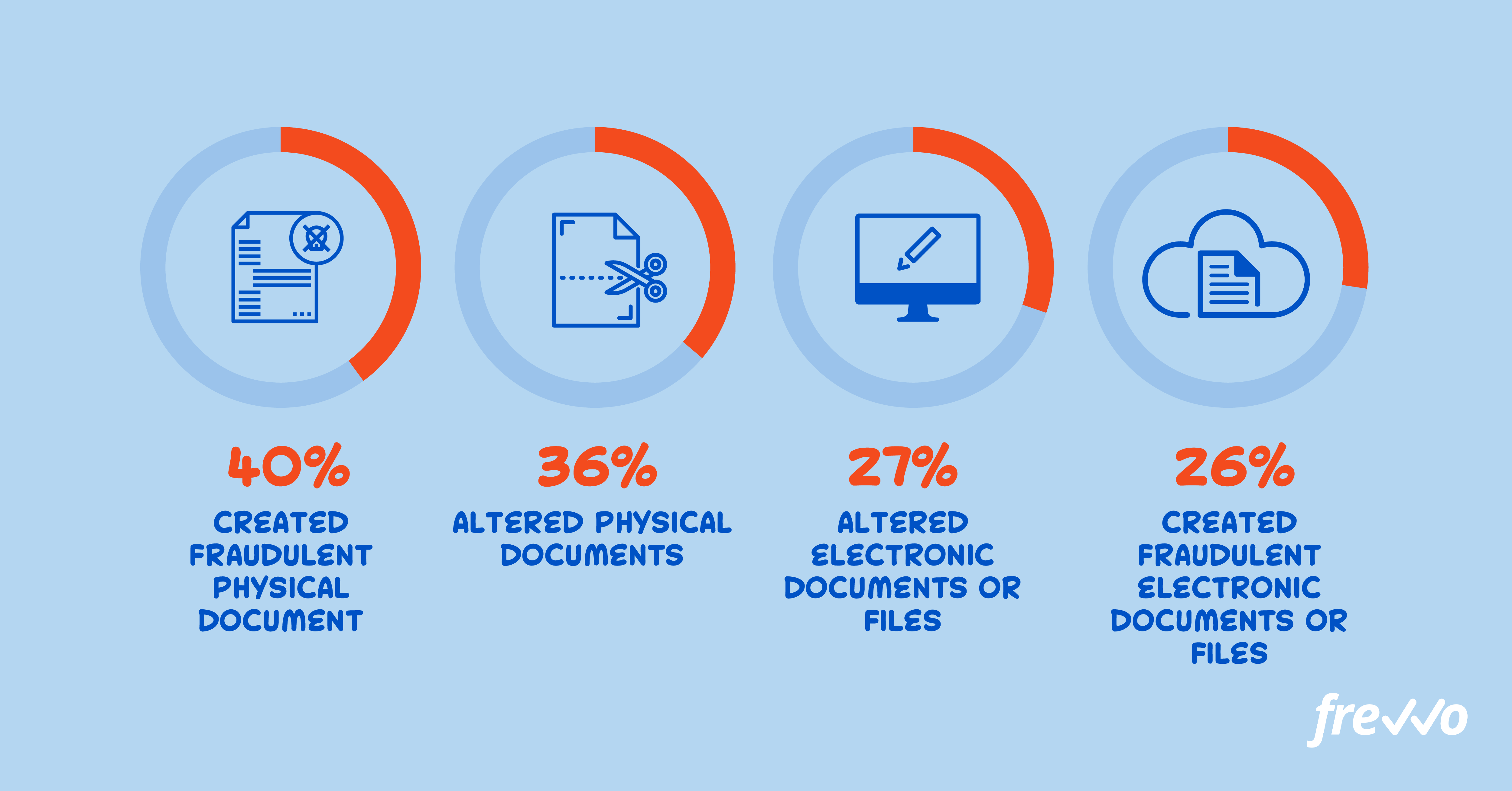

Here are the top concealment methods that employees use to commit expense fraud:

The top concealment method is through creating and altering physical documents (easy to do with image editing software like Photoshop). For example, an employee can overstate or make up bogus expenses on a trip.

One way to prevent expense reimbursement fraud is to automate the expense approval process. This means employees are unable to create or alter physical documents.

You can also set up customized workflows that route an expense report to a CFO or other reviewer if it exceeds a certain value (e.g., anything over $500). Implementing these measures can reduce expense reimbursement fraud.

Increases Visibility

Travel and other reimbursable expenses are part of conducting business. Examples include meeting with clients, paying for meals, purchasing office supplies, etc.

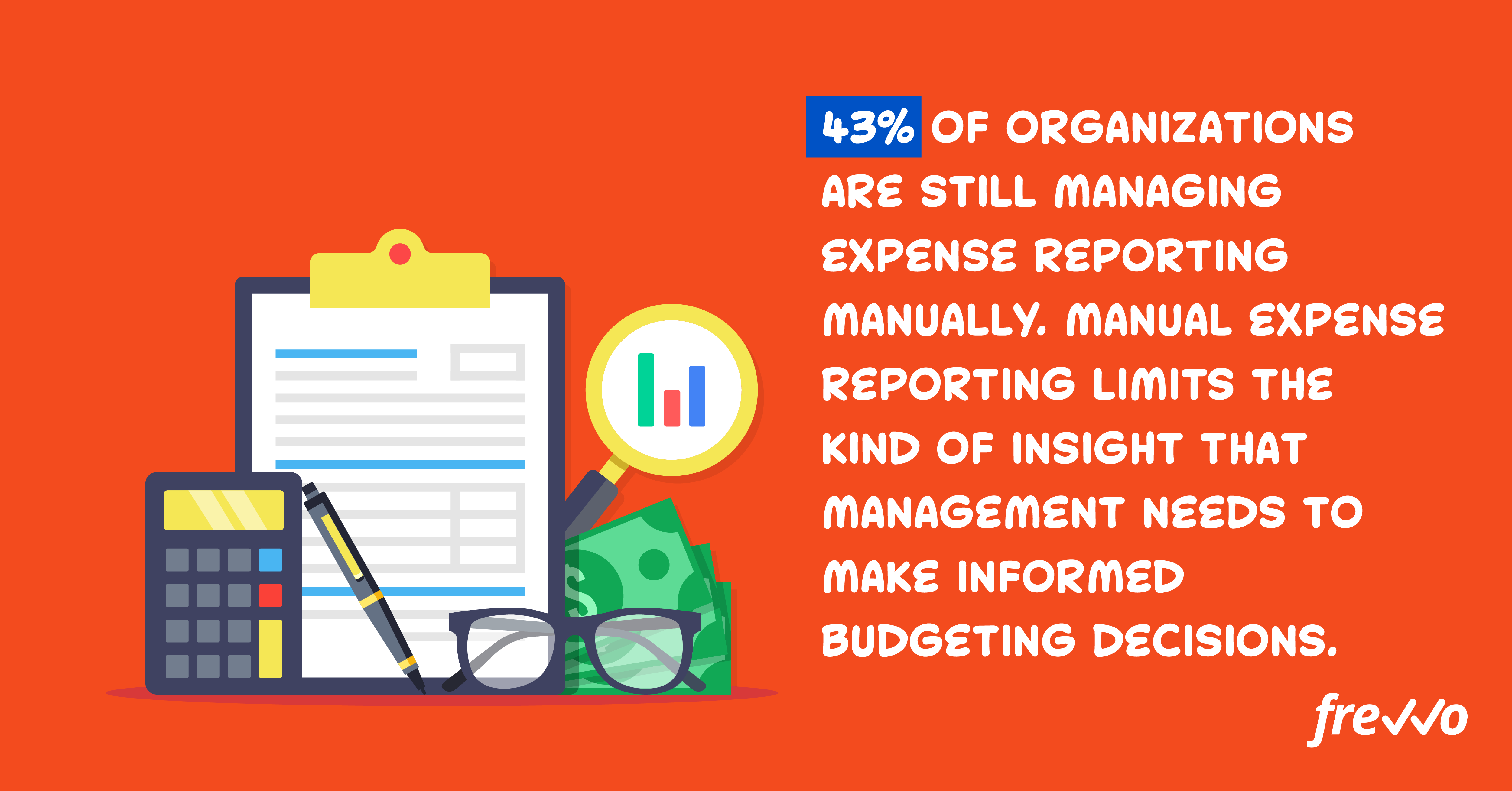

43% of organizations are still managing expense reporting manually. Manual expense reporting limits the kind of insight that management needs to make informed budgeting decisions.

Expense automation solutions enable managers to quickly put together reports in minutes instead of hours. With this increased visibility, managers can see where expenses are going and negotiate better deals with vendors.

Employees can also log in to the system to see where an expense report is in the approval process and receive notifications if anything requires their attention.

To summarize, an automated process for expense approvals improves policy compliance, prevents expense fraud, and increases overall visibility.

Now let’s look at how you can automate and streamline expense approvals.

How to Automate Expense Approvals

With frevvo’s expense approval software, you can automate your expense reporting and build mobile-ready forms.

The software is fully visual, so there’s no coding required. Non-technical users can use the software to design expense forms, set up conditional rules, and create automated workflows.

Follow these steps to automate expense claims.

Step 1: Design Your Forms

Paper-based processes are incredibly inefficient and time-consuming. They take up valuable time that could otherwise be spent on higher-value work.

With frevvo’s expense management software, you can easily digitize and customize your forms from scratch with the drag-and-drop form builder. If you’d rather get a head start, you can also use an expense report template.

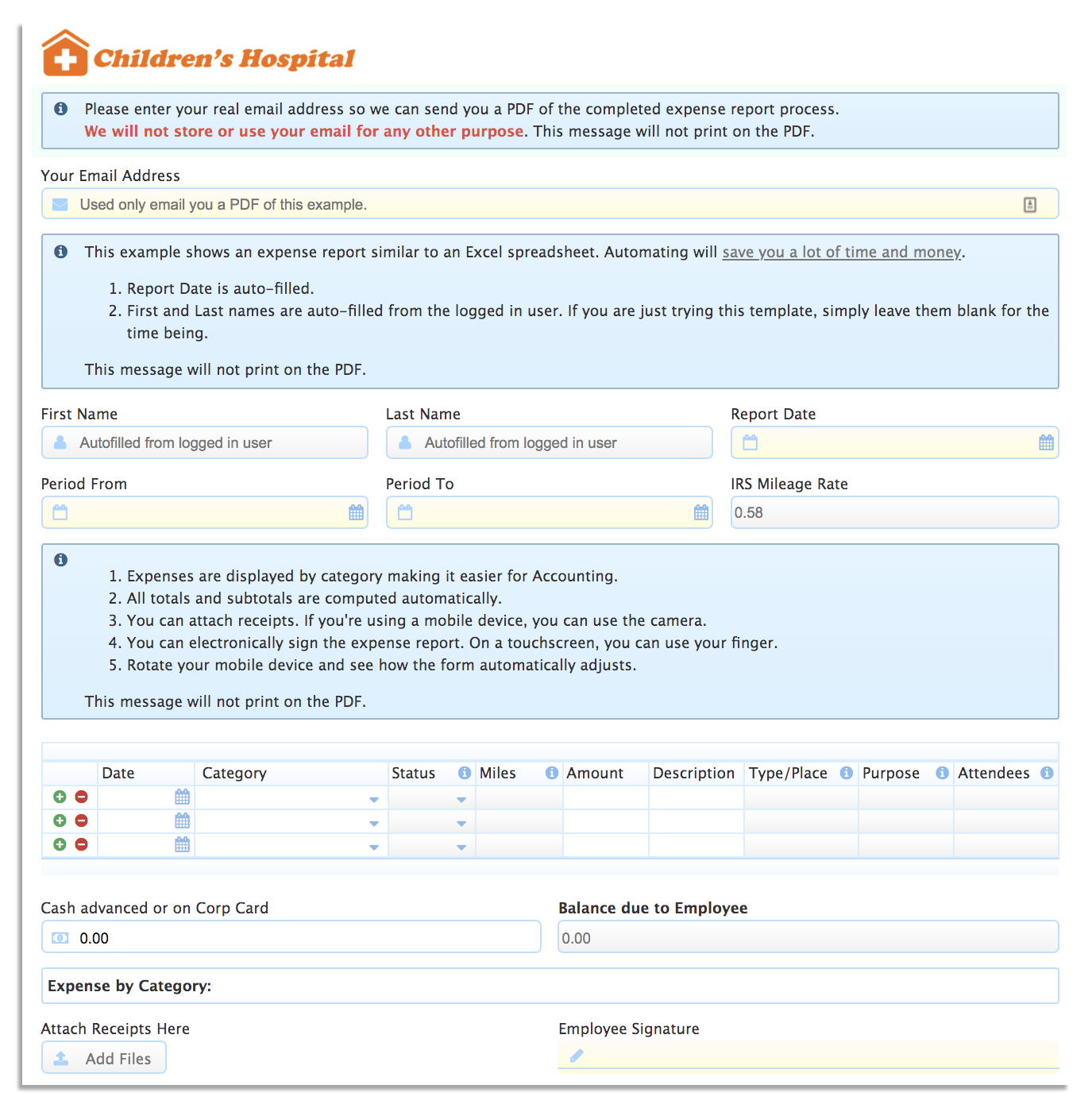

Here’s an example of an expense report form:

You can use the visual tools to customize your forms. With these tools, you can add additional fields, enable electronic signatures, and much more.

The forms are also mobile-friendly out of the box. Employees can submit expense claims and even attach receipts taken with their smartphones.

Step 2: Create Your Workflow

Expense approvals typically follow the same set of steps — an employee submits an expense claim and a manager reviews it before sending it to the finance team for approval.

With expense management software like frevvo, you can create workflows that route documents to the right approver and notify them that their approval is needed.

Employees won’t have to chase down their managers or constantly follow up about the status of their expense claims. With your forms created, the next step is map out each step of the expense reporting approval process.

frevvo’s visual workflow builder makes it easy to map out your workflows and define what happens at each step. You can also add conditional rules to make your workflows more efficient.

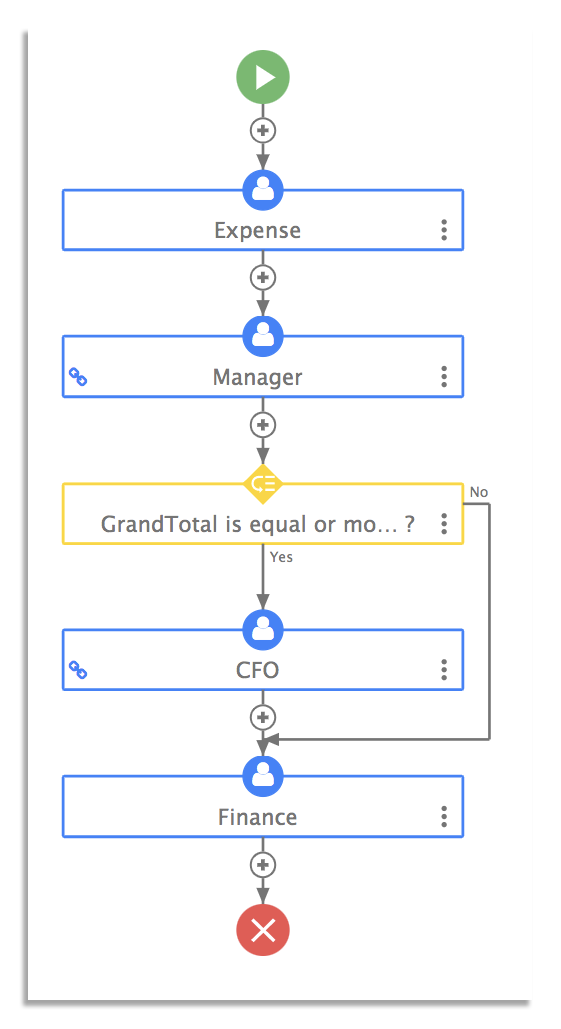

Here’s an example of an expense claim workflow with a conditional rule:

Having a CFO review every single expense claim isn’t the best use of their time. It can lead to backlogged work and longer processing times.

Conditional rules can address bottlenecks and make your workflows more efficient. The workflow above routes expense claims over $500 to a CFO. Everything else is automatically routed to the finance department.

Step 3: Test Your Workflow

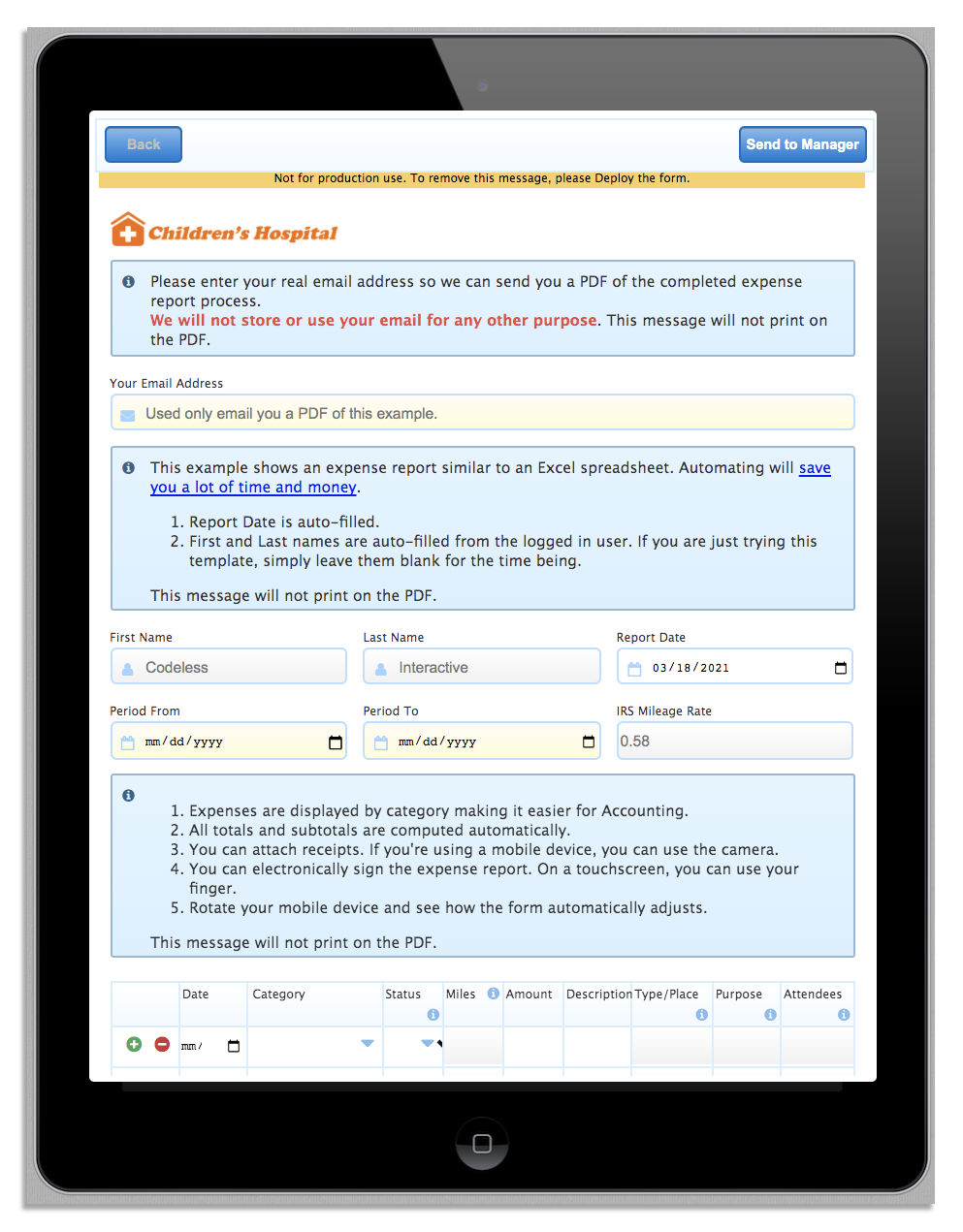

Once you’ve finished creating a workflow, it’s important to run through everything first before deploying it. In frevvo, you can test your workflow and even preview how they’ll look on mobile devices like smartphones and tablets.

Here’s an example of how mobile previews look in frevvo:

Everything will work out as you designed it, including any conditional rules that you added. Be sure to get input from internal stakeholders and incorporate their feedback into the workflow.

Consider testing out your new workflow with a small team to smooth out any hurdles before deploying it across the organization.

Step 4: Communicate the New Workflow

Organizations often need to make sweeping changes to keep pace with evolving markets. But any changes you make to an existing process may meet some initial resistance.

It’s not easy to get employees to change the way they work even if the new way is more efficient. Some employees may be quick to adapt, while others may need more time.

It’s important to develop a strategy around organizational changes. This includes establishing clear goals and providing adequate training for your employees. Consider forming a team to help with the transition and gather feedback.

Take some time to show your employees how to use the new workflow. Once they see how easy it is to fill out and submit expense claims, they’ll be more likely to use it in the future.

Step 5: Monitor and Optimize Your Workflow

When you implement a new workflow, there may be some hiccups along the way. Keep a close eye on your workflows and solicit feedback from your team.

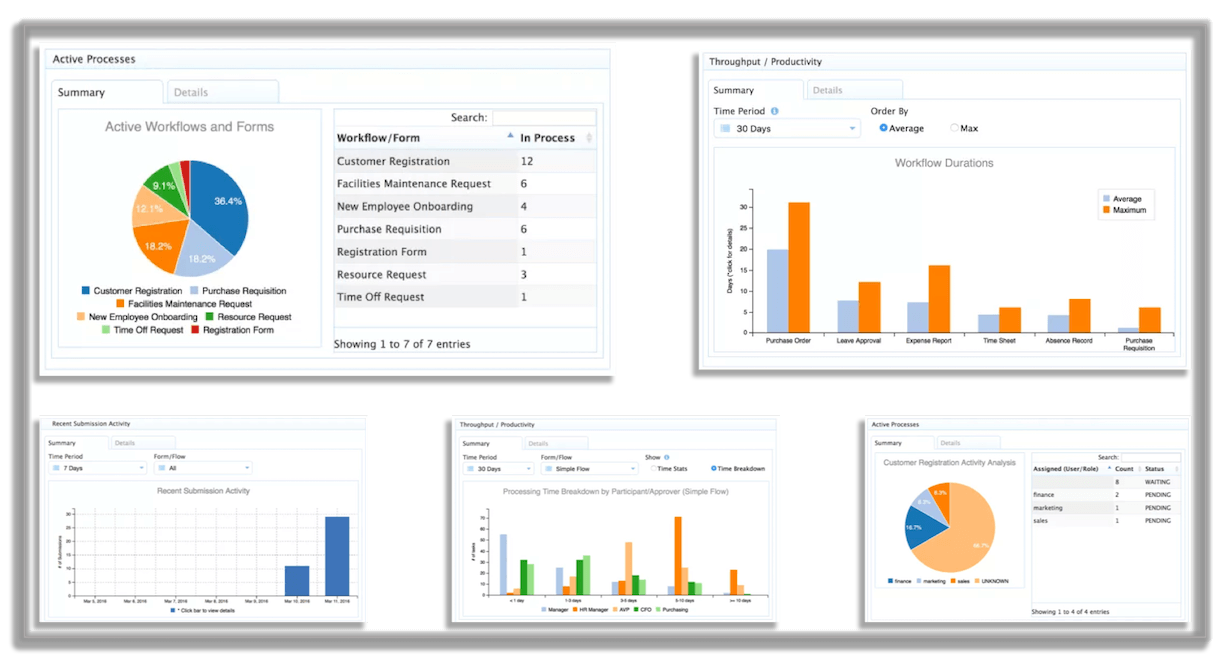

Make a point to revisit your workflows and update as needed to make your expense reporting more efficient. frevvo offers in-depth reports that you can analyze and identify potential bottlenecks.

These reports can help you identify bottlenecks in a process.

For example, if managers are constantly sending back expense claims because they contain out-of-policy items, you may need to make your expense policies more clear.

That could mean revamping your training program or adding a new section to the form that details what items are and aren’t covered.

Automate Your Expense Reporting

Keeping track of expenses that employees incur is important for managing your cash flow. It also allows you to properly reimburse your employees for any expenses they make.

With frevvo’s expense management software, you can automate expense claims and streamline repetitive tasks. This saves your employees, managers, and finance team valuable time.

Ready to automate expense reporting? Then try frevvo for 30 days to see how easy it is to create your own automated workflows.