Many companies are stuck with old processes when it comes to accounting.

They rely on Excel spreadsheets, sending them from employee to employee to make updates and circulate those changes. They hold steadfast to manual approvals, which can take days, weeks, or months for a simple sign-off from busy executives. And they hold their breath waiting for the inevitable human error to create an accounting minefield.

Needless to say, all of this can hinder growth for companies.

But accounting automation can open the door to a better reality.

Automating a variety of accounting and financial operations tasks will lead to smoother operations, saved time, and a better bottom line. In this article, we’ll break down the basics of accounting and financial automation, show which tasks should be automated immediately, and illustrate how to use frevvo to build a scalable financial operation for your growing business.

- What Is Accounting Process Automation?

- The Benefits of Accounting Automation

- 7 Accounting Tasks to Automate Immediately

- How to Automate Accounting Processes in 4 Easy Steps

What Is Accounting Process Automation?

Simply put, automation the accounting process involves using software to automate essential tasks related to finance and accounting. These tasks can include, but are not limited to, accounts reconciliation, updating financial records, and creating financial statements with minimal human intervention.

An article in Accounting Today, noted that it’s a near-certainty that most accounting tasks will eventually be automated — and that this development will be positive for accountants.

“It actually will be machines that unlock an accountant’s ability to share their judgment, enriching their employment experience and perceived value within the organization,” the article notes. “No matter how proficient machines become in automating transactional accounting tasks, they will never come close to the abiding value of an accountant — his or her judgment.”

One important thing to note is that accounting process automation is close to, but distinct from robotic process automation (RPA). While RPA merely provides a temporary fix for aging, legacy systems, accounting process automation is generally about using software to overhaul arcane financial and record-keeping operations.

In other words, it’s about rethinking the entire accounting process and imagining it as a streamlined, automated system that works with as little human effort as possible.

Of course, that spells big savings — in both time and money — for any business that is currently using employee time to manually add, update, check, and process financial documents.

Let’s look at the specific benefits.

The Benefits of Accounting Automation

There are numerous benefits associated with finance process automation. While it can’t — and shouldn’t — completely replace human workers, it can greatly assist them and free up their time for more high-value work.

Some of the benefits associated with finance process or accounting automation are better data integrity, since the potential for human error is lessened. A single mistake can be catastrophically expensive for a business, blowing up years of goodwill from the public.

Automation also leads to improved efficiency and speedier approvals — consider that while managers can approve a purchase order in two days, it might take higher-ups such as the chief financial officer upwards of a week. And it’s not just approvals that get faster. Automation can speed up customer payments, too.

Then there’s the improved visibility that automation offers. By this, we mean that automation can provide companies with a greater internal look at what’s working and what isn’t with their data.

Start to finish, accounting automation can remove the chance of costly mistakes by workers.

From capturing accounting data to manipulating and interpreting it, accounting automation software can handle much of the grunt work. This doesn’t necessarily have to eliminate employees, as the automation can free up time for more high-level quantitative and qualitative analysis.

In time, automation could transform accounting, offering great benefits to the businesses and firms that incorporate it into their processes.

A piece by temporary staffing giant Robert Half noted that accounting automation could impact routine tasks, compliance, customer interaction, and strategy.

“It’s unlikely software or robotic finance professionals will completely replace humans any time soon,” the piece noted. “However, accountants who want to future-proof their careers will increasingly need to work with automated tools to deliver the best possible service.”

Robert Half

7 Accounting Tasks to Automate Immediately

With a basic understanding of accounting automation, here are seven processes for them to immediately consider automating.

1. Purchasing

When companies purchase goods or services, there’s generally a lot of paperwork involved from purchase orders to contracts to other forms. Purchase order automation can help make sure nothing gets lost and that all required forms in a procurement process go where they should.

Automating purchasing activities can give you the security and protection of multi-step AP processes, without the time and costs associated with manually reviewing and processing paperwork by multiple stakeholders.

2. Travel & Mileage Reimbursement

Companies can burn hundreds of hours per year simply filing, processing, and verifying minor operating expenses like travel and mileage reimbursements. This process isn’t just superfluous, but it’s harmful to productivity across the entire organization.

With automation, employees can head into work trips with their travel pre-approved and reimbursement all set. There’s no quibbling with accounting or waiting weeks after the trip to get reimbursed for expenses.

3. Expense Reports

One thing that’s changed a ton in accounting in the past 10-15 years for a lot of companies has been the submission of expense reports. For eons, these reports were handwritten or printed-out spreadsheets from Microsoft Excel with stapled receipts, taken over on-foot to a company’s accounting department.

To be sure, many companies likely still handle expense report submission this way.

But in recent years, it’s also become possible for employees to automatically fill out and route expense reports. Better, they might not even have to submit receipts, since some software can integrate with payment platforms, capturing and storing transactional data.

Automated expense approval software not only saves the accounting department’s time, but it frees up the entire company from rote administrative work.

4. Accounts Payable

While more companies treat accounts payable like a necessary evil, the truth is that the AP department holds an enormous amount of power over the entire business operation. Without efficient AP processes that follow best practices, companies can lose favor with important vendors, rack up expensive fees, or just not receive important goods or services when they need them.

Automation can help companies know when supplies need to be ordered, payments need to be sent out, and invoices tracked.

5. Sales Order Process

With automation, companies can spell out every step of their sales order process, ensuring that nothing is left to chance and that orders go out on time, with everything in them, and at the right price.

6. Payroll

Why have an operations manager or human resources employee stumbling over payroll every pay period? This can become a nightmare for companies as they grow, consuming vast resources to assure everyone gets paid on time.

Automation lessens the payroll headache, notes one accountant, who writes, “As a fan of automation, I love services and features that allow me to put things on autopilot so things like payroll can be completed, handled digitally and ensure you won’t miss any important filings like 941 or a DE9.”

Automating employee payroll is a no-brainer for any organization spending time manually processing each pay period.

7. Monthly Closes

The monthly close process can bring a ton of stress and uncertainty for companies.

A recent survey from Docuware noted that 90% of respondents were under pressure to close their monthly financials quicker, with just 39% satisfied with their close process and an abysmal 28% of people trusting their month-end close numbers. Automating the monthly close process can ease frayed nerves while providing more accurate data for companies.

How to Automate Accounting Processes in 4 Easy Steps

The best kind of accounting automation software offers a range of different functionality, to tackle a variety of common issues. frevvo was built to help businesses of all types and sizes automate tedious tasks and workflows to streamline operations, trim overhead, and reduce errors.

Accounting and financial automation is one of frevvo’s most common use cases.

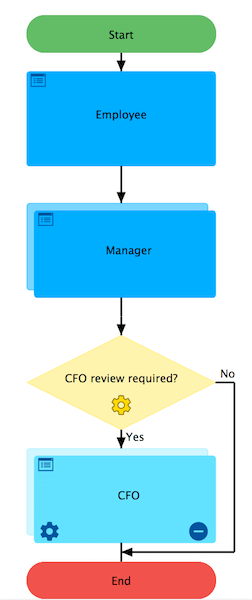

frevvo’s financial process automation software makes it incredibly simple to build a complete custom automation workflow for your business. Starting with pre-built templates, you can quickly adjust the form fields, define the workflow routing, set any conditional parameters, and launch the process to your entire team — literally in minutes.

Because frevvo uses a 100% visual workflow interface, there’s no coding required.

Let’s walk through the specific steps for creating your own accounting automation workflow.

Step 1: Select a Workflow Template to Begin

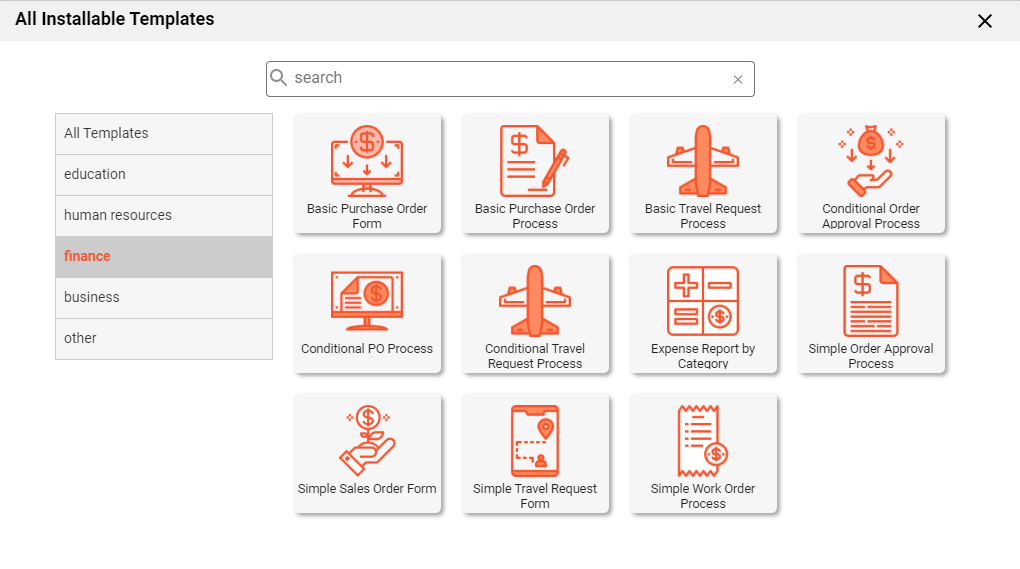

frevvo offers more than 30 workflow templates that span nearly every aspect of your business operations. This makes it easy to get started with the process, since most of the accounting automation tasks outlined in this article can be created by modifying one of our pre-built templates.

In this case, let’s try automating expenses, since that workflow can be such a time sink for both the accounting team and the rest of the company.

To find the one for expense reports, go into the template applications, select “Expense Report by Category,” and click the “Install” button.

This will create a basic Expense Report workflow that you can customize to fit your specific business needs.

2. Customize the Pre-Built Expense Report Form to Meet Your Needs

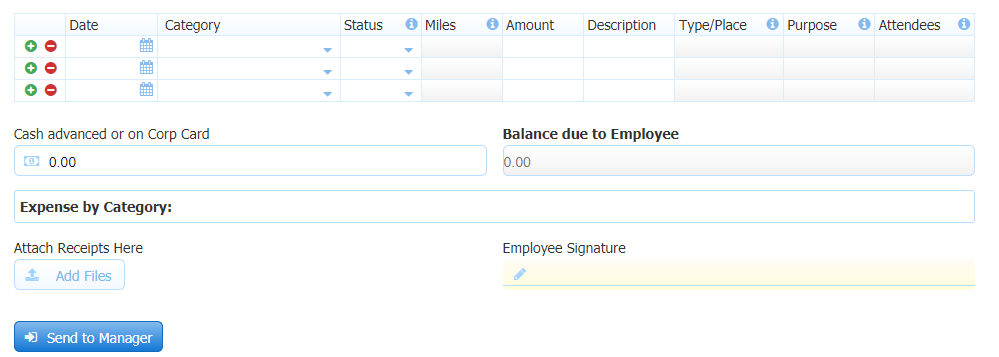

The expense report workflow template includes most of the fields that businesses generally collect when they process expense reports.

Where possible, form fields are auto-filled (e.g. employee name and email address are automatically filled in based on the logged in user).

Employees can add details about each expense, assign a category, define the amount, or any other fields that could be relevant. You can customize each of these fields in order to collect any specific categories or other data about each line item to align with your accounting needs.

With this basic form, employees can enter their information, attach receipts, and even electronically sign the submission.

You can use the drag-and-drop editor to make changes to the form as needed.

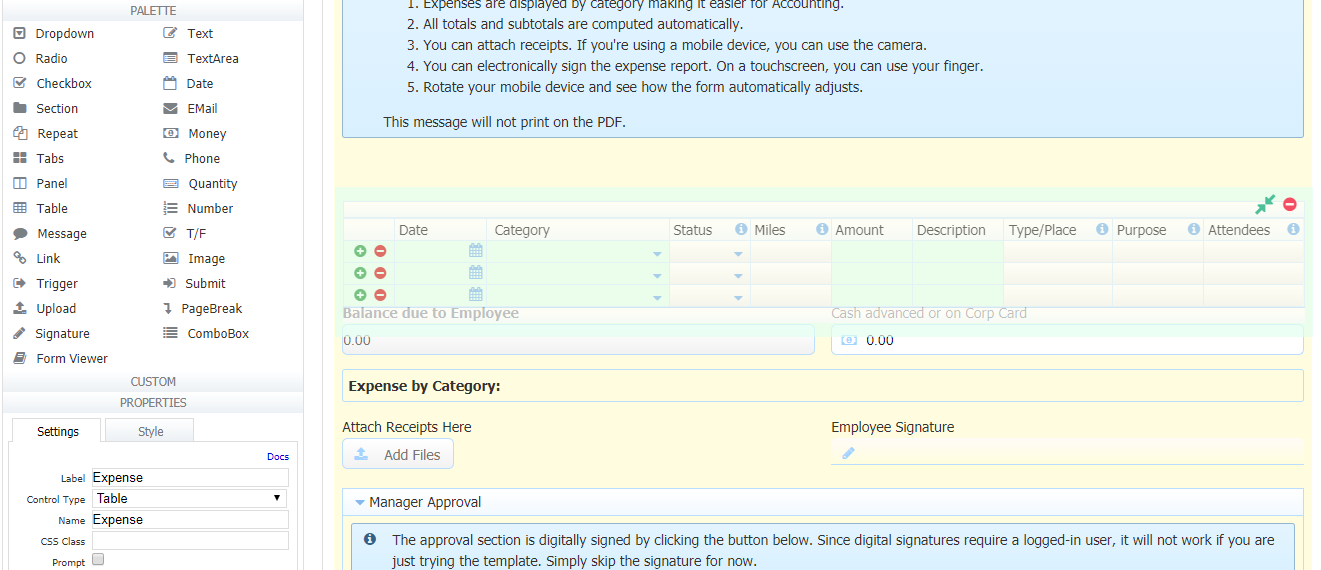

Step 3: Use the Workflow Designer to Set the Order for Approval

Sometimes expense reports are a matter of an employee submitting directly to accounting.

Other times, the reports must go through a couple of channels of managers and executives. frevvo’s workflow designer gives users the power to delineate all the levels of approval. Simply drag and drop as needed.

By editing the workflow, you can add, remove or rearrange steps in the process as needed. At this stage, you want to include all possible steps that may be required to finalize the expense report.

You can also specify what happens once the expense report has been approved and finalized.

Next, we’ll add some rules to the workflow that route it to the right people under the right circumstances.

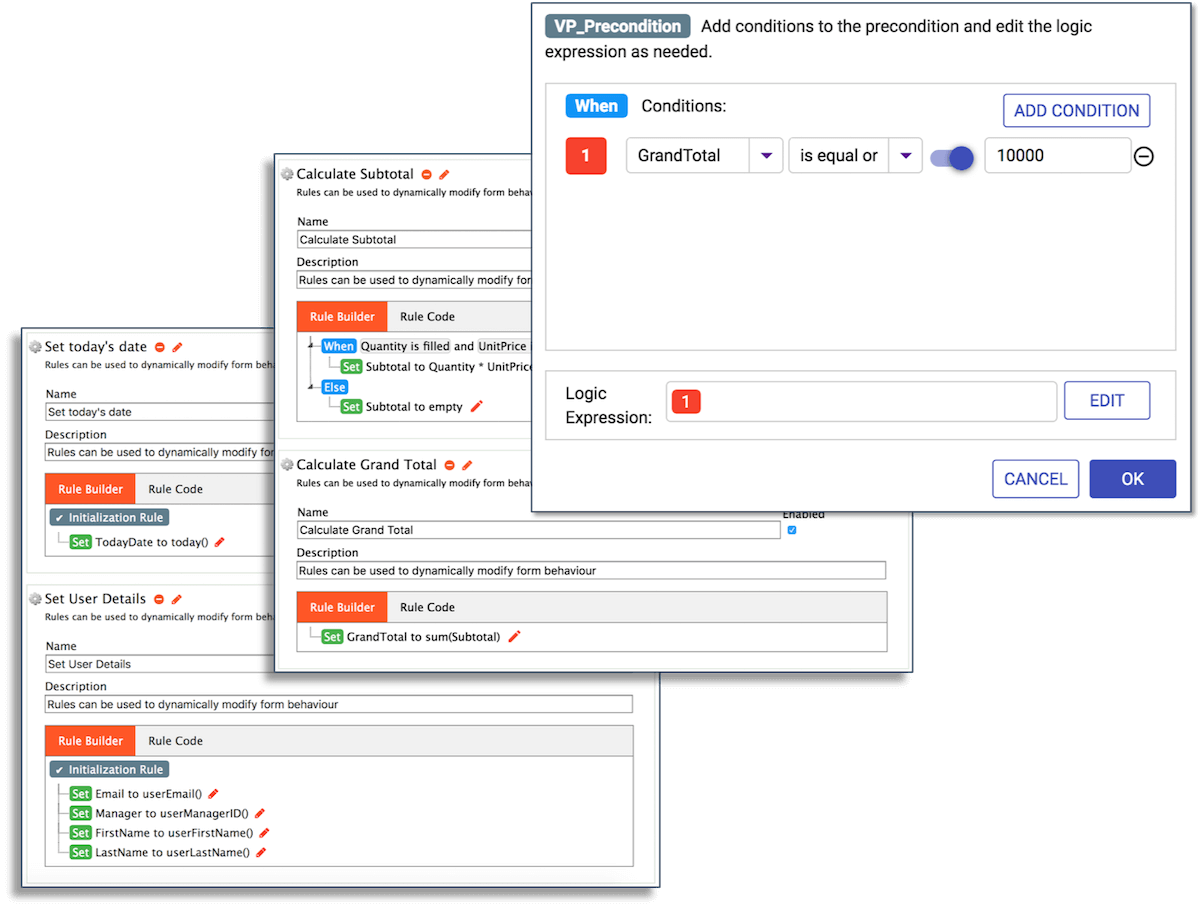

Step 4: Use frevvo’s Visual Rule Builder to Add Business Logic Where Needed

Sometimes, conditional approval steps must be added at each step of the process for expense reports. Perhaps the chief financial officer must see an expense report only if it exceeds $10,000.

Use frevvo’s Visual Rule Builder to easily add in conditional logic where it’s needed. It’s 100% visual and so easy to use that anyone who knows how to use a spreadsheet can create business logic without writing JavaScript or any code whatsoever.

Once you’ve set up your rules, you’re ready to test and deploy.

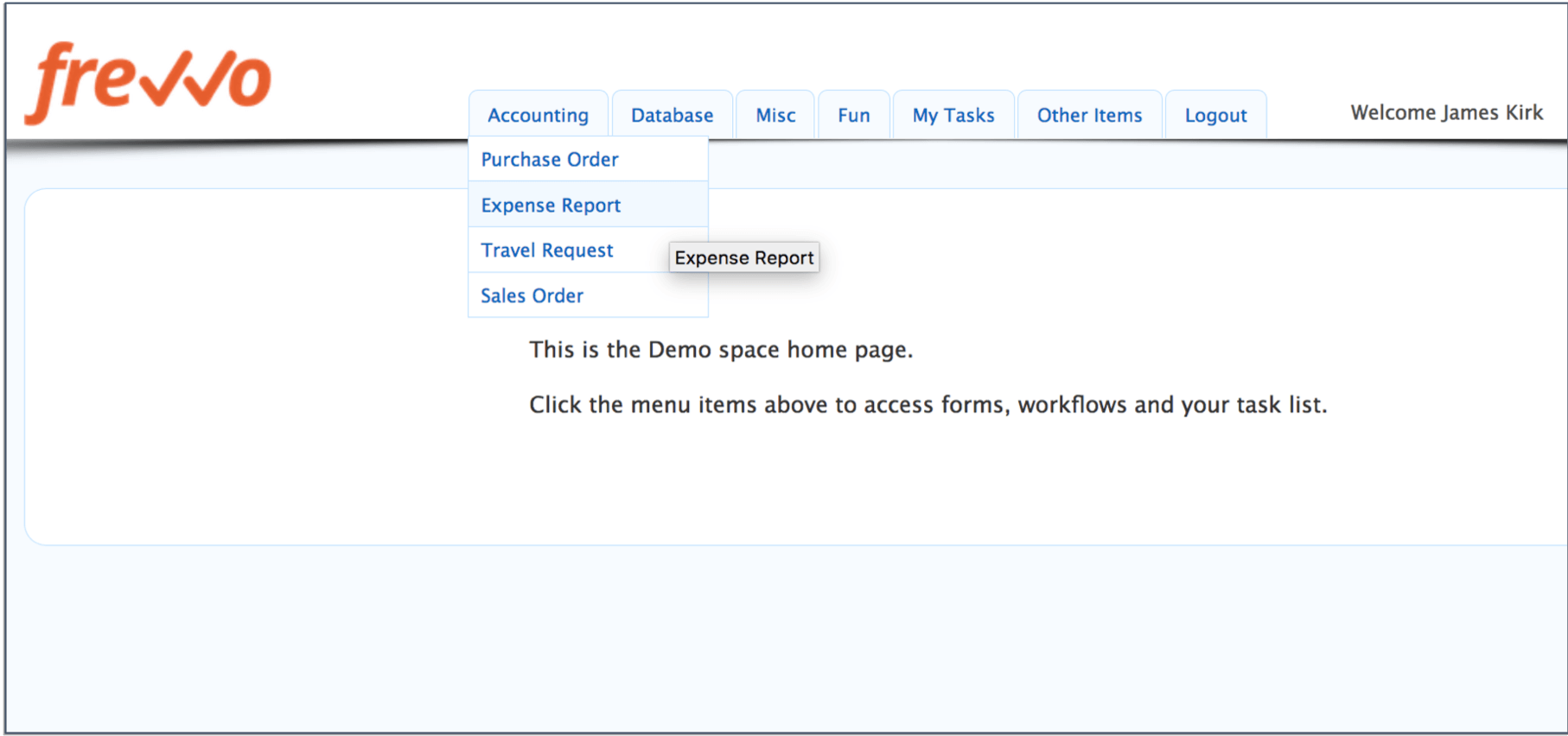

frevvo includes built-in portals so you can provide employees with a great looking, easy to use way to access all your accounting and other processes.

The portal automatically enforces access control, looks great, and works naturally on desktop computers as well as mobile devices.

Of course, if you prefer, you can also just send a link to the form to employees and they can begin using it right away!

Your customized expense report will automatically look great and work naturally on mobile devices. That means a manager or VP who’s traveling can approve from anywhere at any time. That speeds up reimbursements for employees and keeps them in sync with the status of the process. The best part – you have to do nothing. frevvo forms and workflows automatically support all mobile devices without coding.

Automation doesn’t end with a deployed process. To gain maximum efficiency, you need to track and optimize performance. Fortunately, frevvo includes a number of reports and analytics so you can find the bottlenecks in your workflows and optimize them to gain even more ROI from process automation.

With frevvo, you can automate a range of other accounting applications, including purchase order submission, sales order forms, and mileage reimbursement. Each workflow takes just a few simple steps to setup and deploy.

Don’t wait any longer to eliminate these tedious and time-consuming tasks from your day.

Try frevvo for free to see how easy it can be to automate your accounting in just an afternoon.