Every business, whether its offering is a product or service, has expenses. Suppliers or vendors need to be paid for their products and services, and they need to be paid accurately and on time if you want to maintain good supplier relationships.

Accounts payable (AP) plays a vital role in any organization, whether it’s a one-person accounting operation in a small business or a whole finance department in a large enterprise. And at the heart of any AP department is the invoice approval workflow.

What Is an Invoice Approval Workflow?

Quite simply, an invoice approval workflow is the process of approving invoices before payment is processed.

It’s a simple sequence of events to ensure that the invoice is legitimate and that there are no discrepancies between the invoice and the original purchase documents, such as the purchase requisition, purchase order, order confirmation or other procurement/sales documents.

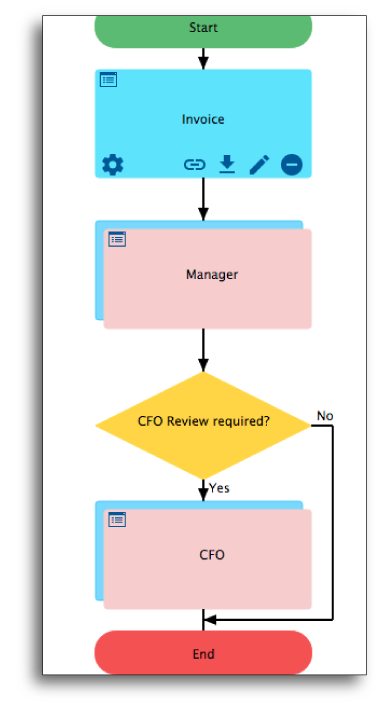

Here’s what a typical invoice approval workflow looks like:

Invoice Approval Workflow Steps

These are the steps involved in a typical invoice approval process:

1. Invoice Received

The business receives an invoice from a vendor or supplier.

2. Invoice Verified

The invoice is verified by the staff member responsible for procuring that particular type of product or service. Verification typically involves matching the invoice with the appropriate purchase order (PO) for the product or service.

3. Irregularities/Exceptions Flagged

Invoice irregularities can include pricing discrepancies and missing information such as a PO number. The invoice is sent to the relevant parties to address/correct the irregularity, after which it’s sent through the approval workflow again.

4. Invoice Approved

The invoice is sent to relevant personnel for approval. Depending on the products and services being ordered or the billed amount, this approval chain can be dynamically determined.

5. Payment Released

The approved invoice is sent to the person/department responsible for accounts payable for processing and the vendor is paid.

6. Bookkeeping

A permanent record of the transaction is added to the organization’s books.

That’s it – the whole process in six quick steps. The invoice approval process may seem simple, but multiply this by dozens or hundreds of vendors and thousands of invoices and you quickly have a complex situation on your hands.

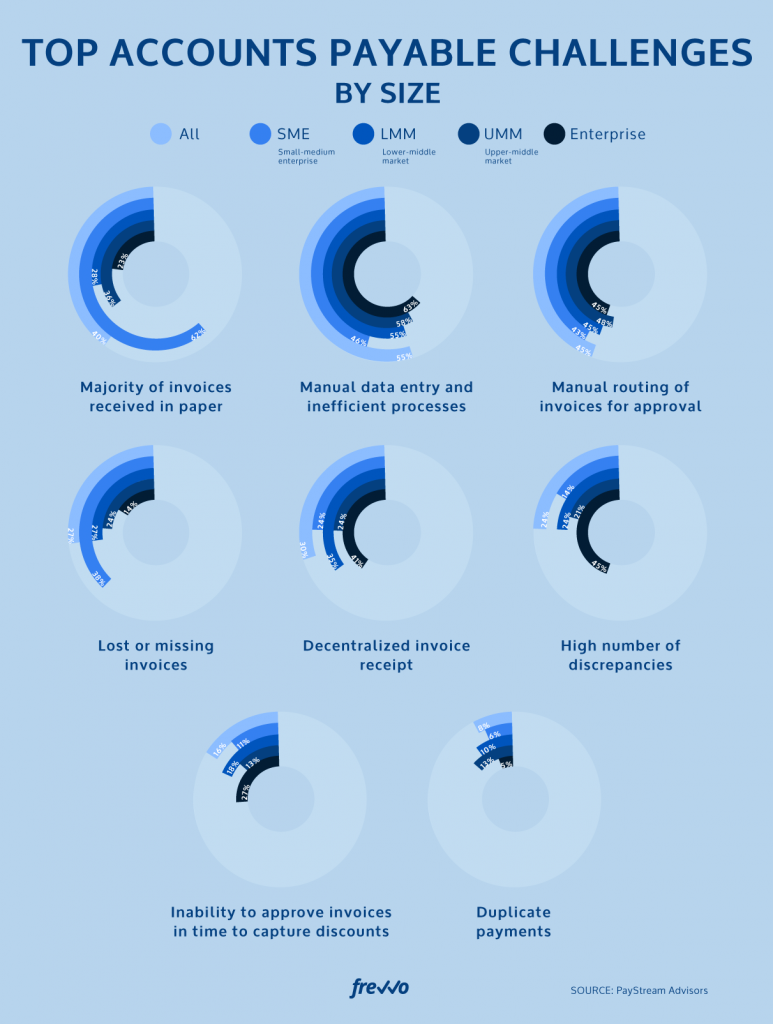

Challenges of Manual Invoice Approval Workflows

Performing invoice approvals manually comes with a number of challenges that can have a considerable impact on your organization’s ability to conduct its business as effectively and efficiently as possible.

Wasted Time

Manually processing invoice approvals is enormously time-consuming. Accounts payable personnel spend many precious hours reconciling invoices against purchase orders (invoice matching), following up on invoices – via email, over the phone or even in-person – to confirm the accuracy of invoices and track down missing documents.

Missing Documents

When dealing with large numbers of invoices in different formats (paper-based, email-based, PDFs, Faxes, etc.), it’s not unheard of for invoices to get misplaced and forgotten about, or even for the original purchase order document to go missing, making it much harder for Accounts Payable employees to do their work effectively.

Slow Approvals

Without workflow automation, invoice approvals can take a long time, particularly when they end up lying on the manager’s desk or sitting in their email inbox for days or weeks. This situation can get even worse if multiple approvers are involved and there isn’t clear visibility into who is responsible for the approval or which stage of the workflow the invoice is currently in. Meanwhile, the person responsible for paying invoices has to keep following up to keep the process running.

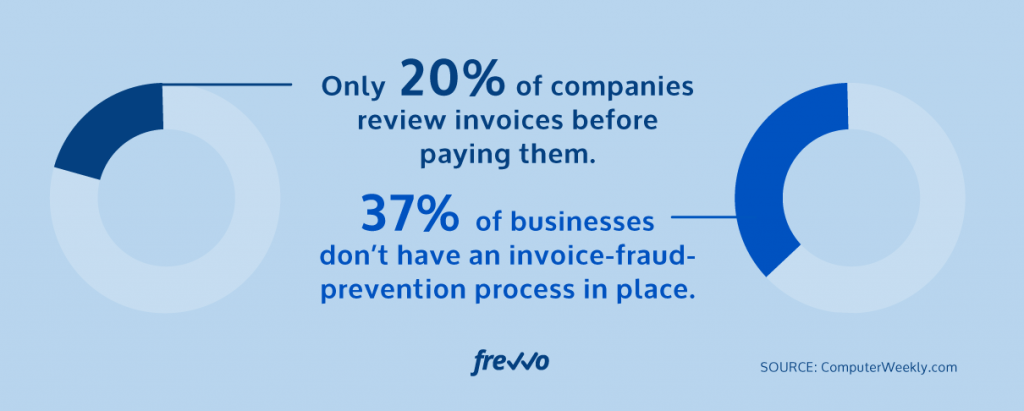

Lack of Visibility and Exposure to Fraud

Manual invoice approval workflows result in greater exposure to fraud due to the fact that there is far less oversight and visibility into the accounts payable process. This leaves the gate wide open for fraud. Now, you might be shaking your head, thinking that your employees would never steal from your organization – and that might be true! – but email fraud is on the rise, with fraudsters imitating legitimate vendors and sending fake invoices.

Late Payments

These kinds of bottlenecks can result in late payments, which can sour supplier relationships and even lead to delays in your own product or service delivery due to materials, products or services not being delivered as a result of missed payment deadlines. As a result, late invoice payments can have a ripple effect and result in damage to your organization’s reputation among your own customers.

Missed Savings Opportunities

Many vendors offer early payment discounts, allowing businesses to save money if they pay their invoices in a timely manner, within the first ten days of the invoice. While this may not seem like much – it’s usually around 2% of the total invoice – it can add up to a considerable sum over time, particularly when dealing with big orders or a large number of suppliers.

Costly Errors

Human error can result in invoices being overpaid or underpaid and/or bookkeeping inconsistencies due to manual data entry. Think about the repercussions of a misplaced decimal point! Aside from the obvious problems of lost money or disgruntled suppliers, these kinds of errors can cause additional problems further down the line if your books get audited and there are discrepancies.

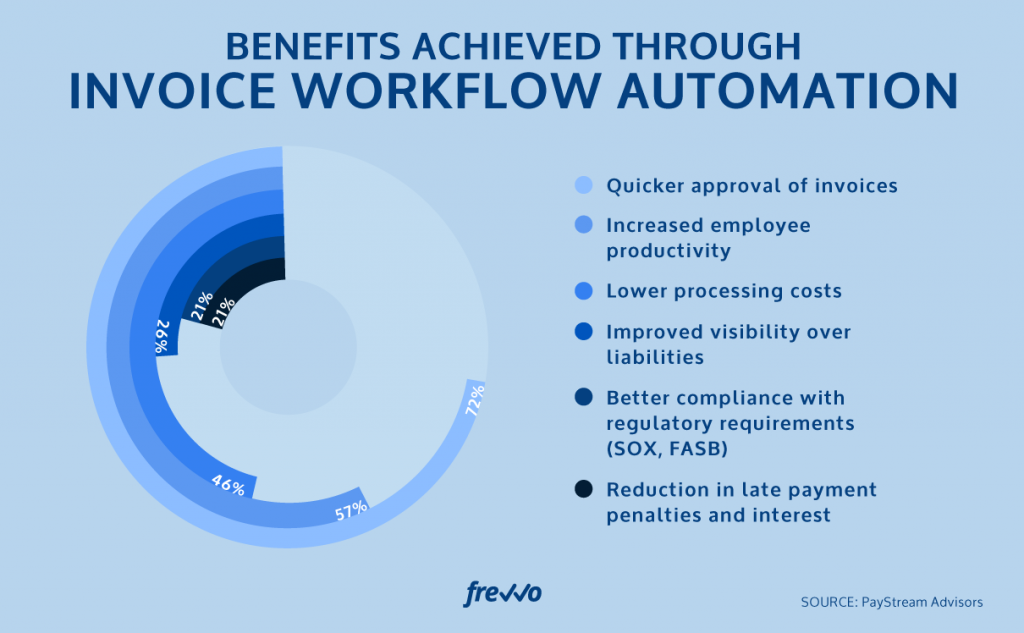

Benefits of Automating Your Invoice Approval Workflow

Automating your invoice approval workflows offers a number of benefits.

Save Time and Eliminate Errors

Digitizing and automating your invoice approvals workflow means your AP team no longer has to chase down invoices and other documents such as purchase orders and manually compare them to ensure the legitimacy of each invoice. Instead, these documents are contained within the same workflow and can be matched against each other easily.

Automated workflows can also integrate with databases or other accounting systems and even perform this matching automatically without any human action.

Now instead of spending countless hours on the phone or sending endless emails, your finance professionals can focus on more meaningful tasks – such as analyzing your expenditure for efficiency gains – while your workflow automation software ensures that each invoice is routed where it needs to go for approval.

No More Missing Documents

When everything’s digital and automated, you never need to worry about missing documents or forgotten invoices again. In fact, you can configure rules in your workflow that ensure that forms cannot be submitted unless all the information and attachments you need are included. You can also easily integrate your workflows with your document management system and your bookkeeping software to update your records automatically.

Additionally, by eliminating paper documents from your AP processes, you can save a fair bit of money on paper, ink and document storage, with the added benefit of making your operations more sustainable.

Faster Approvals

With automated notifications and reminders, you can virtually eliminate bottlenecks caused by invoice approvals going unnoticed or getting put on the backburner. What’s more, with fully mobile-responsive forms and electronic signatures, managers can approve invoices on-the-go, so being out of office needn’t cause delayed approvals and payments anymore.

Improved Vendor Relationships & Early Payment Discounts

By automating your invoice approval workflow, you can eliminate late payments and be proactive about taking advantage of early payment discounts. This can help you to establish better relationships with your suppliers, which can result in better deals in the future.

Improved Business Intelligence

With fully digital workflows, you’ll gain access to valuable data about your business processes and expenditure, allowing you to implement better reporting mechanisms and make more informed strategic decisions, which can, in turn, result in higher profit margins.

Effortless Regulatory Compliance

Automating your invoice approval workflow gives you access to a full audit trail of every transaction, making regulatory compliance much easier to achieve. Additionally, using an automation solution with built-in accessibility features makes ADA and WCAG compliance effortless.

Reduce Fraud Exposure

Automating your Procurement and AP processes can significantly reduce your vulnerability to fraud by increasing visibility across the board and putting additional checks in place. Automatic comparisons between POs and invoices can help flag irregularities, and other measures such as information change request forms with authenticated electronic signature verification can prevent bad actors from making off with your business’s hard-earned money.

Want to automate your invoice approval process?

Try frevvo’s simple invoice approval software free for 30 days. No coding or I.T. required.

How to Automate Your Invoice Approval Process in Three Easy Steps

As we’ve seen, automating your invoice approval workflow has numerous benefits for business. But how do you go about automating your invoice approvals in the first place?

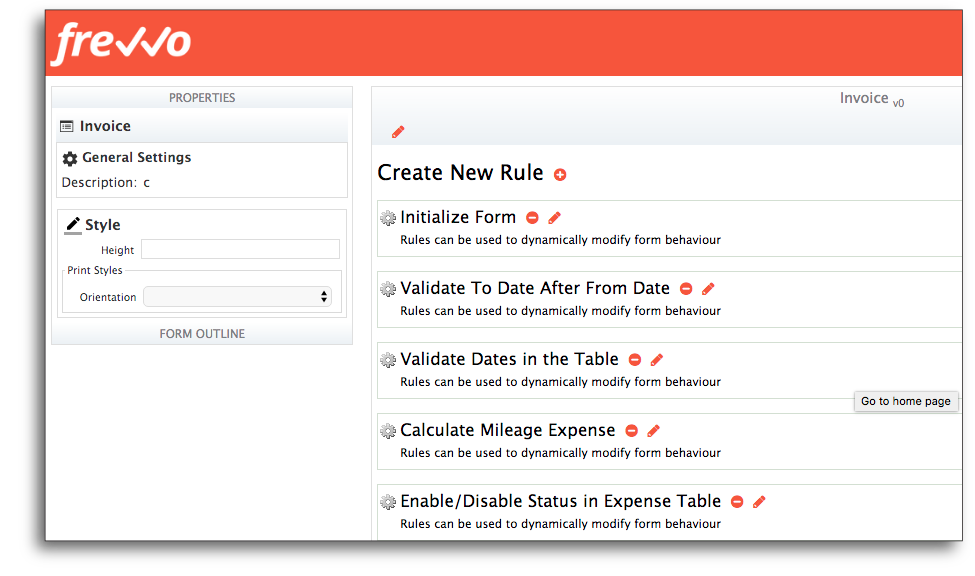

With frevvo’s automated invoice approval software, you can set up your account in minutes and automate your invoice approval process in a few days. With its intuitive drag-and-drop interface, you don’t need any coding knowledge or help from I.T. to set it up. It’s as easy as 1-2-3.

What’s more, it’s free for the first 30 days.

1. Start with a Pre-Built Template or Create a Form from Scratch

Start out by installing a pre-built invoice approval workflow with a single click. Customize it using frevvo’s drag-and-drop form designer to create a dynamic digital form that contains all the fields and rules your organization requires. If you prefer, you can also start from a blank form and customize it using the same intuitive designer.

It’s worth noting that frevvo allows you to export the data from forms to PDFs and that you can customize these to look exactly as you want them to by customizing your form design and previewing the resulting PDF.

2. Design a Workflow

With your form ready, it’s time to map out your approval process with frevvo’s workflow designer wizard. Just like the form builder, this tool is 100% visual, allowing you to drag-and-drop the various steps (and parties) of your approval workflow into place. You can also configure conditional routing rules such as additional approval spend thresholds.

3. Run Your New Invoice Approval Workflow

Now it’s time to watch your new invoice approval workflow in action and see how much simpler the whole process is when it’s automated. As you collect data on invoice approvals and analyze it using the built-in reports, you can easily identify bottlenecks and optimize your workflow in real-time to improve efficiency.

For best results – and added security – consider a complete procurement automation solution to automate your entire procurement workflow and make invoice approvals a subsidiary workflow within that larger process.

Why frevvo?

frevvo’s best-in-class workflow automation software is suited to meet all your invoice processing requirements, whether you prefer to work in the cloud or with an on-premise solution.

- frevvo is affordable even for small and medium-sized businesses, and because it’s so easy to use, you don’t need an enterprise I.T. department (and budget!) to run it.

- frevvo is securely encrypted and offers seamless integration with authentication systems like SAML and Active Directory to keep your sensitive financial data safe from illegitimate access.

- We pride ourselves on the fact that our solutions promote accessibility and are ADA and WCAG-compliant right out of the box.

Sound good? Try frevvo absolutely free of charge for 30 days.

Quickly and easily automate your invoice approval process.

Try frevvo’s simple invoice approval software free for 30 days. No coding or I.T. required.