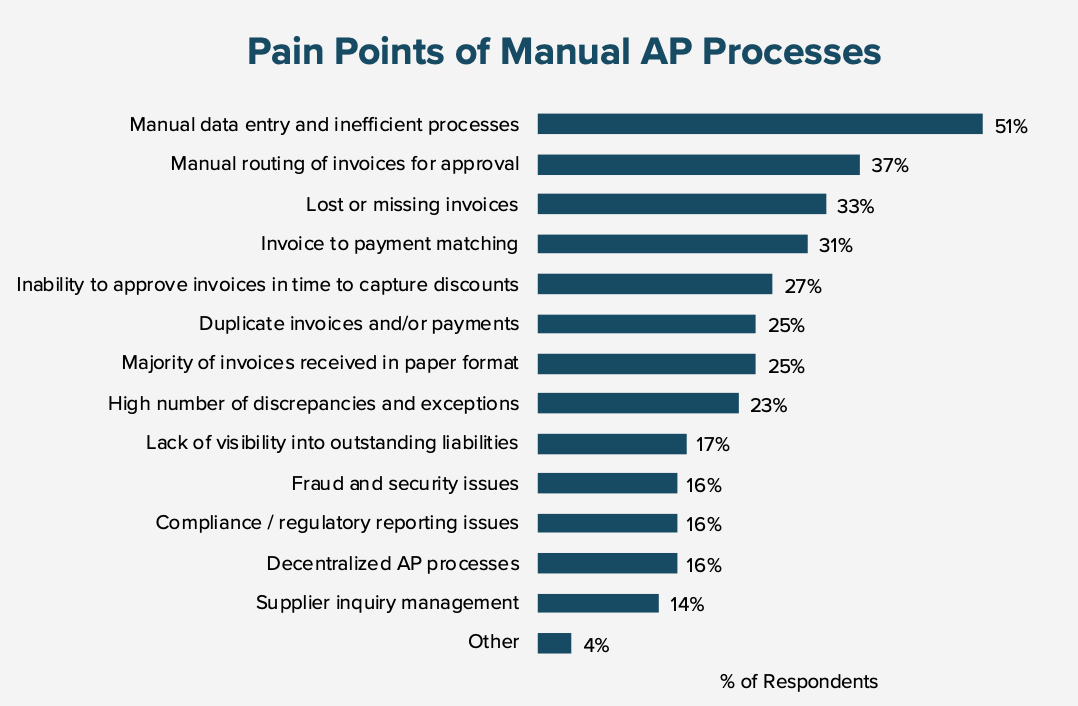

Over half of all organizations say that manual accounts payable (AP) processes are inefficient.

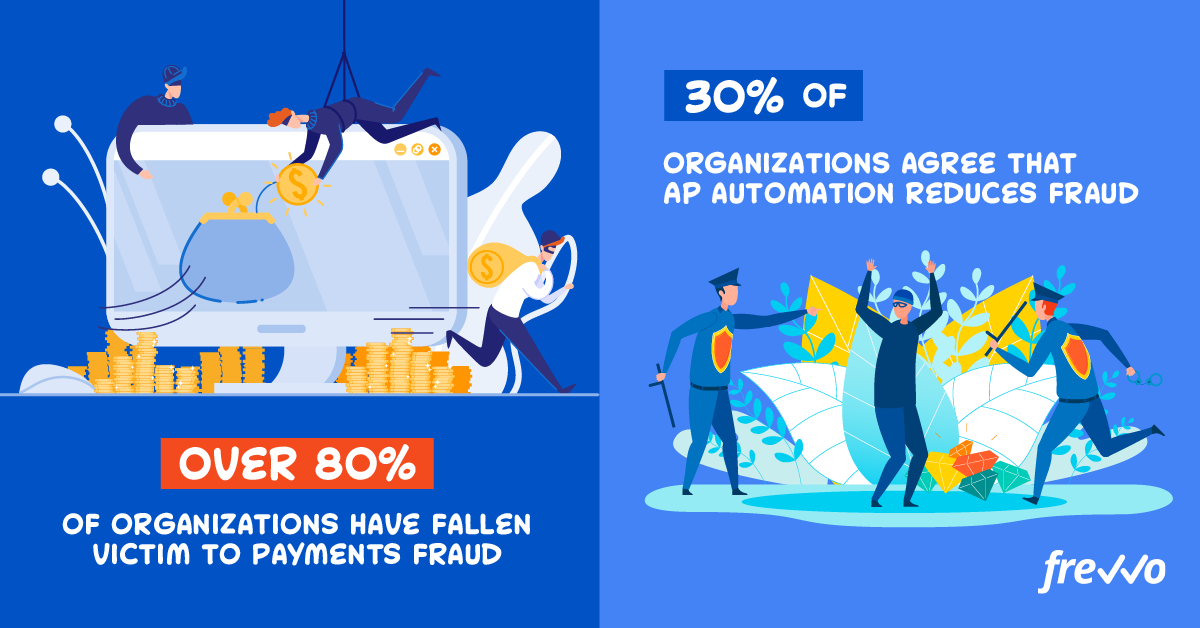

Not just that, but 16% of organizations admit that they experience fraud issues associated with manual accounts payable processes.

Rather than struggle with slow, error-prone AP workflows, companies switch to accounts payable automation solutions.

They cut out mistakes, reduce processing costs, and build stronger supplier relationships.

Read on for some concrete accounts payable automation examples and learn why your company should implement accounts payable automation.

Want to skip ahead? Click here.

- What’s Accounts Payable Automation?

- Accounts Payable Automation Examples

- Why Switch to Accounts Payable Automation?

- How to Automate AP Processes

What’s Accounts Payable Automation?

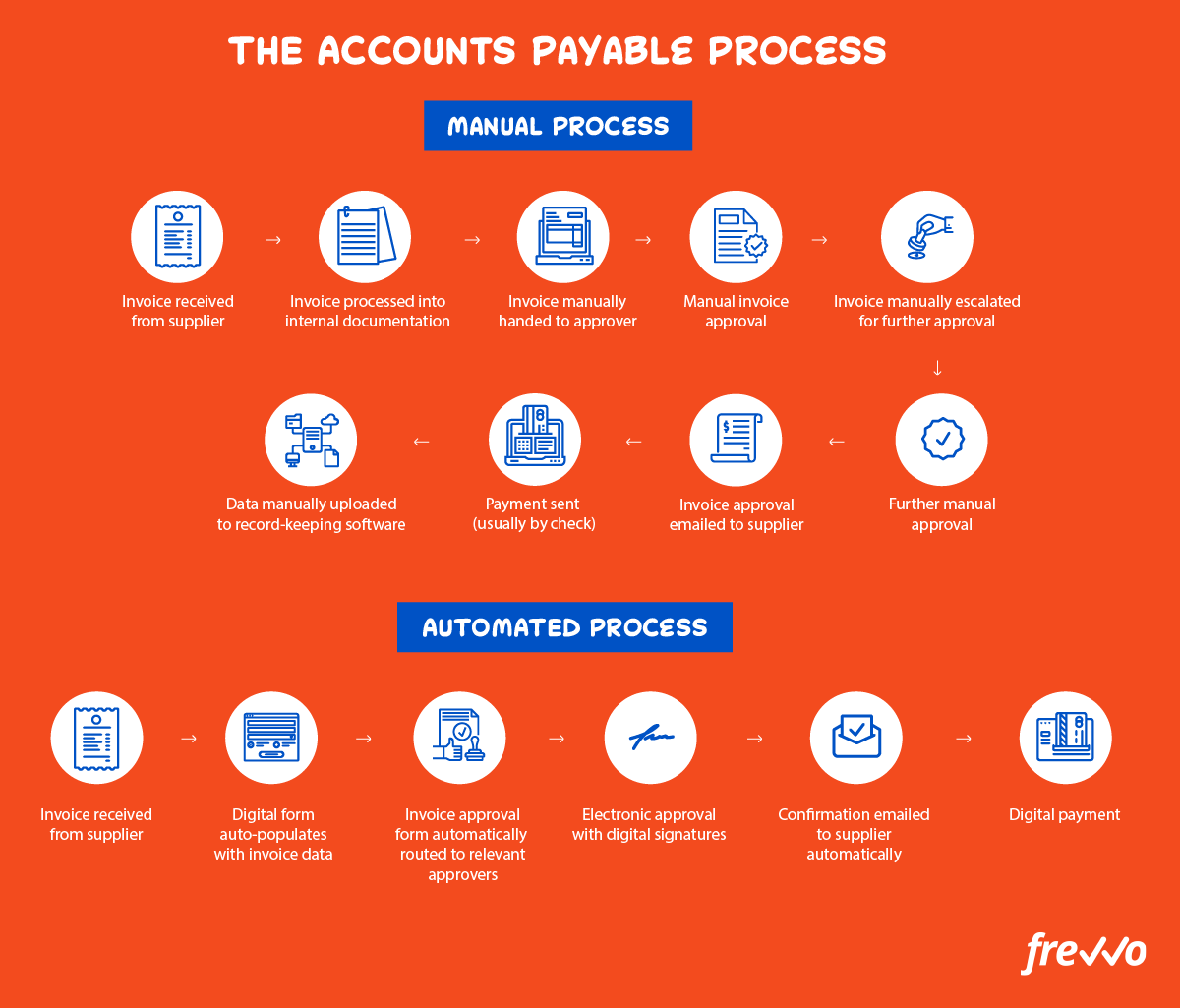

The accounts payable process is the final part of the procure-to-pay cycle.

The AP process begins when your company receives a vendor invoice and finishes after the invoice is paid and filed. During the AP process, invoices are checked against the purchase order and goods receipt, and any discrepancies are addressed.

The problem with manual AP processes is that not only are they slow, but there are also often errors in the invoice data. An invoice error means that the paper invoice has to be sent back to the supplier, delaying the process further.

Not only do 42% of business leaders agree that automation software can speed up repetitive, manual tasks, you’ll also find that the auto-validation capabilities of accounts payable software prevent errors from occurring. This leads to higher levels of accuracy and prevents error-related delays.

Plus, by automating the accounts payable process, you reduce the possibility of fraud.

Currently, one in five organizations experiences procurement fraud, while nearly 30% of firms experience accounting fraud.

Automated accounts payable software reduces the chaos associated with your manual process.

Fraudsters often take advantage of this disorganization to commit fraudulent acts. Since an AP automation solution centralizes all incoming invoices and internal approvals, this streamlines the process and cuts out the opportunity for fraud.

What’s more, AP automation software makes it easier to implement extra approval layers. With multiple levels of approval, fraudulent activity is easier to spot.

Accounts Payable Automation Examples

There are several examples of where you can automate activities in the accounts payable process.

Populate Forms with Invoice Data Automatically

Invoice processing can be a slow business when done manually. When invoices are received from the supplier, the accounts payable department has to manually enter data into the system to kick off the invoice approval process.

With automated invoice processes, you can connect your database to the workflow. That way, your digital forms automatically pull key data from your databases to reduce the need for manual data entry.

Automatically Validate Invoice Data

In a conventional manual process, if there are errors or discrepancies, the invoice is sent back to the supplier. This causes a delay.

With automated accounts payable software, digital forms automatically validate to ensure all invoice data is correct.

This prevents errors or discrepancies delaying the process.

Automate Invoice Approvals Processes

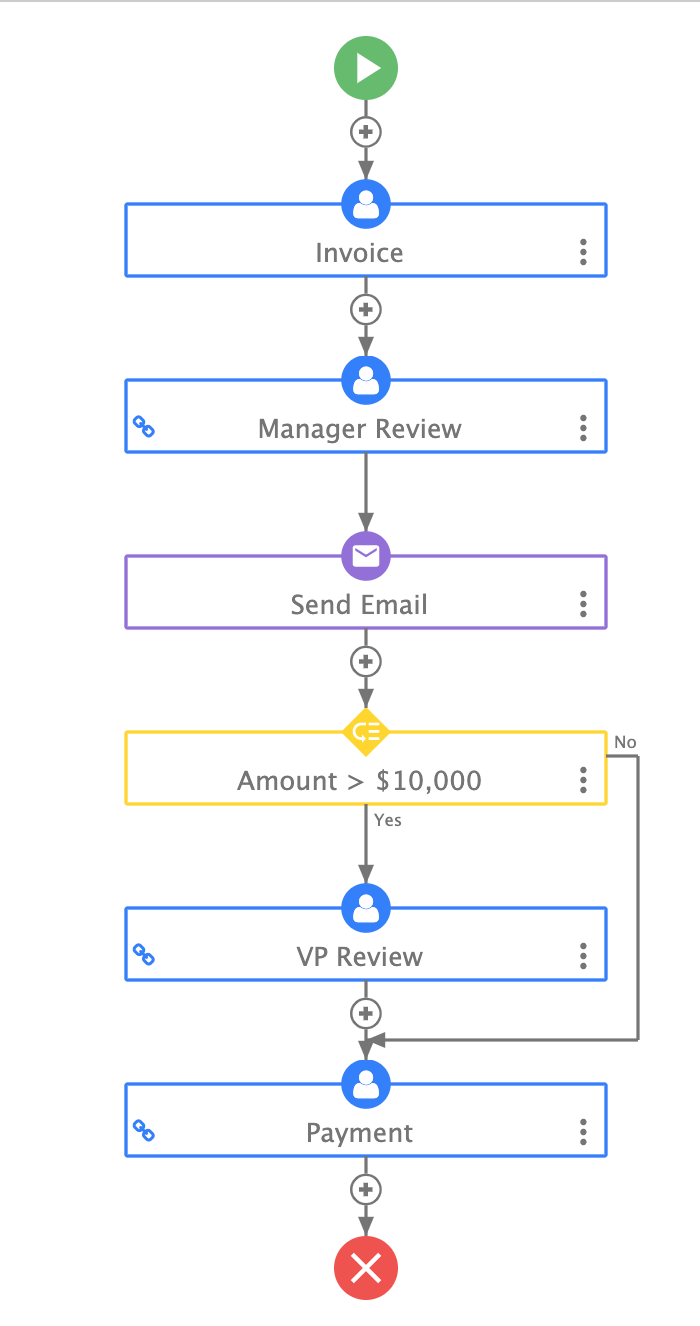

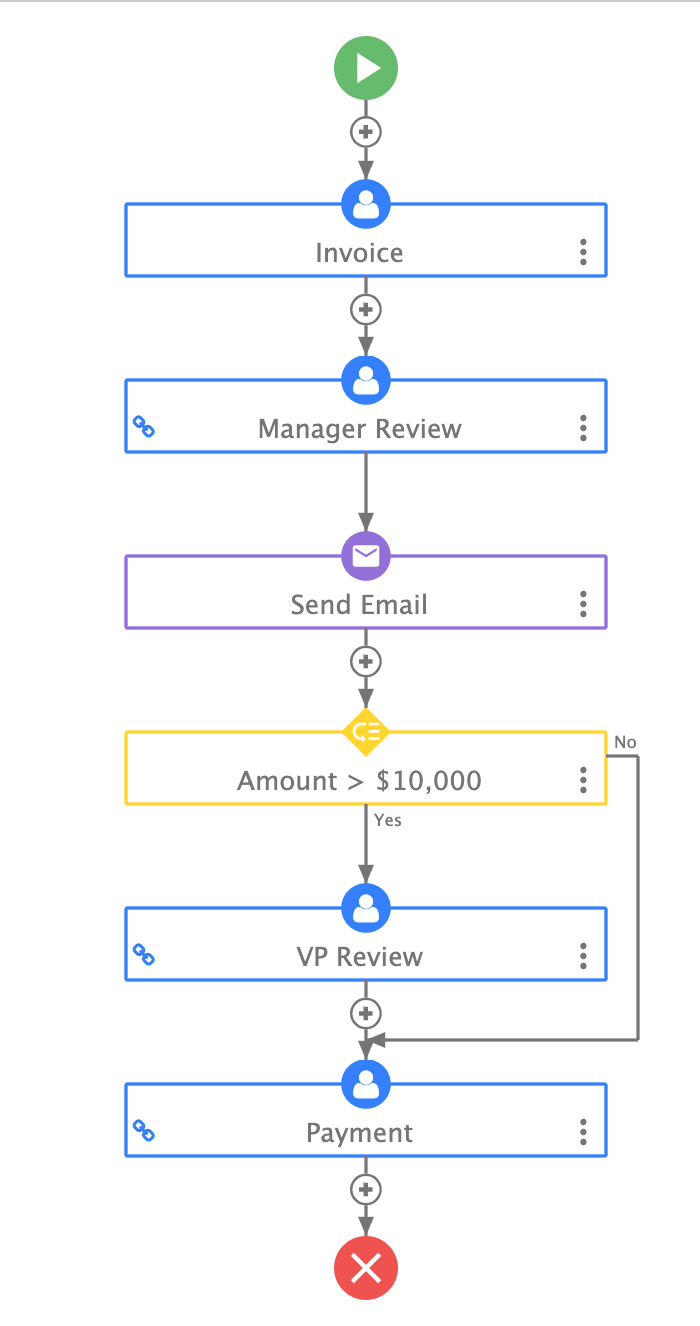

Invoices will often need to be approved by senior staff members. You may have a conditional approval process where invoices need to be approved by more than one staff member if a certain amount is exceeded.

With manual accounts payable processes, this requires staff to manually hand over paper invoices for approval. Not only does this increase the chances that paperwork will get lost, documentation often gets buried on a manager’s desk that’s piled up with paperwork, causing delays.

With an automated accounts payable solution, you can design complex workflows so digital forms automatically route through the appropriate approvers based on the information in the forms.

Approvers get an automated notification to let them know that an approval is pending. They’ll also be sent an automatic reminder if they fail to sign the document electronically. You can also set escalations so that if there’s a big delay in approval, documents are automatically passed to a secondary approver.

Communicate with Suppliers Automatically

If you’re handling invoices by hand, you’ll need to manually email your suppliers whenever there is an update to their payments. This step can be time-consuming and it’s easy to forget.

With automated AP software, automatic communications are forwarded to suppliers to keep them updated as to the approval status of their payments. An email lets them know that their invoice has been approved and that their payment is on the way.

Automate Record-Keeping

With manual accounts payable processes, record-keeping is done by hand. Documents are scanned into the system and staff are tasked with huge amounts of data entry.

These processes are prone to mistakes. Errors in the audit trail can cause compliance issues.

By automating AP processes, you can integrate your record-keeping systems with your automated AP software. All documentation automatically uploads to your record-keeping system to keep a complete, up-to-date audit trail.

Why Switch to Accounts Payable Automation?

If you still use a manual process to handle accounts payable, you’re likely running into a whole bunch of issues.

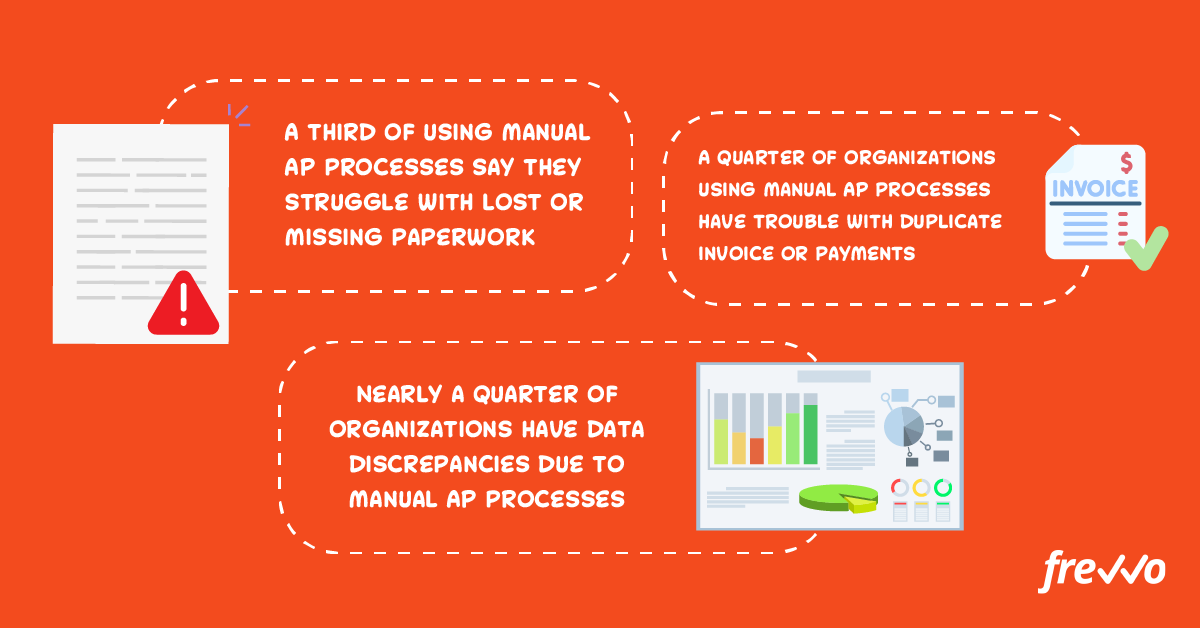

Over half of organizations agree that the process is inefficient, while a third admit that they suffer from lost or missing invoices, and 23% cite errors as a problem.

Plus, a quarter of companies say that duplicate invoice issues plague their accounts payable department, while 37% agree that manual routing is a hindrance.

There are also huge security issues involved with manual AP processes: 16% of firms report fraud issues, while a further 16% have run into compliance problems.

AP automation can help put a stop to these glitches. Here’s how.

1. Prevent Payments Fraud

Over 80% of organizations have been a victim of payments fraud.

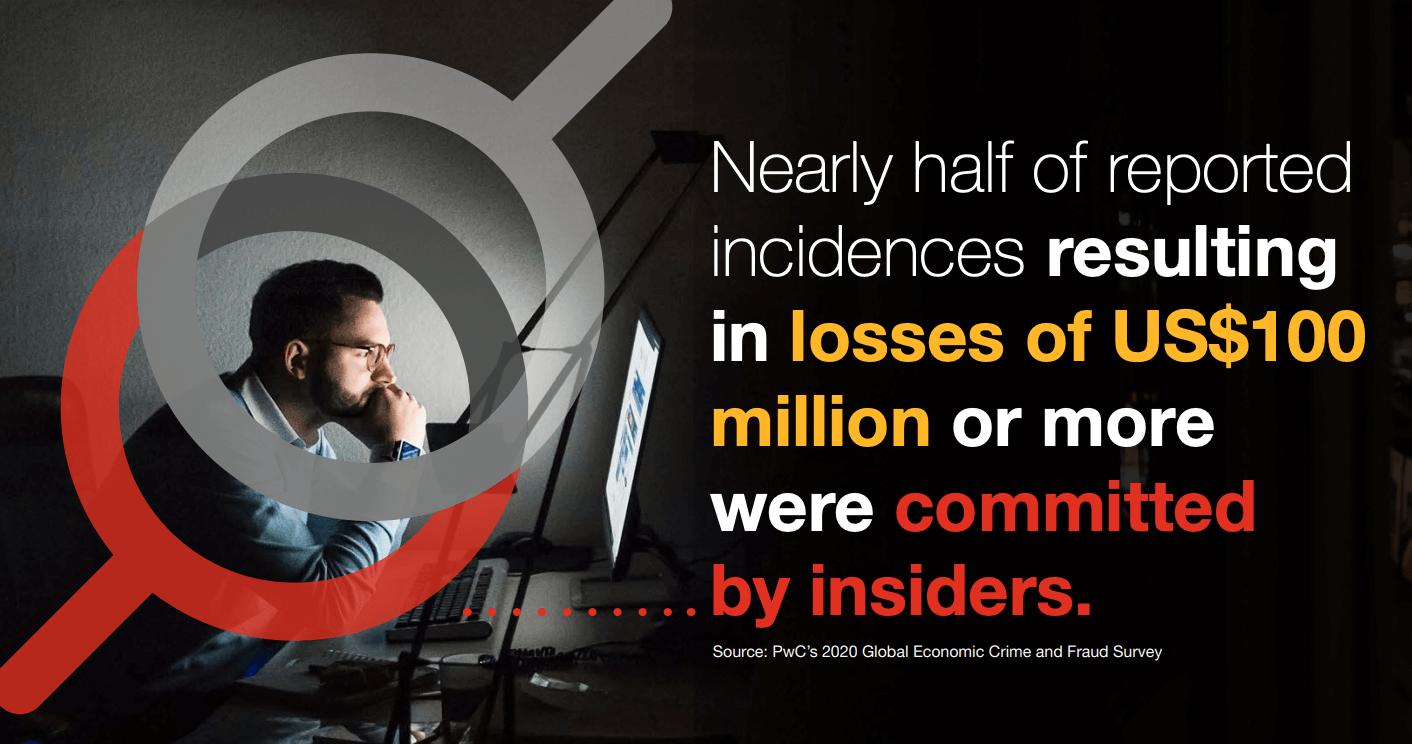

While 61% of payments fraud cases are down to compromised business emails by external hackers, almost half of reported losses of $100 million or more were inside jobs.

Unfortunately, internal fraud happens across all levels of the company. 34% of fraud is committed by middle management, 31% by operations employees, and 26% by senior management.

Accounts payable automation is crucial in the fight against fraud.

In fact, 30% of organizations strongly agree that AP automation reduces fraud.

While manual AP processes are easy to manipulate and hack, AP automation provides a digital audit trail that’s automatically validated. As calculations are automated, and data is validated, it’s tougher to manipulate invoices.

Plus, AP workflow automation software automatically routes documentation through as many approvers as necessary. Making it easier to authenticate documentation on multiple levels creates more opportunities for senior staff to spot fraudulent activity.

2. Accelerate the Accounts Payable Workflow

Manual AP processes are slow. Not only is manual data entry time-consuming, manual approvals mean paperwork needs to be taken to approvers in person.

What’s more, there are often delays in the process.

For one thing, errors in a paper invoice mean the paperwork has to be returned and resubmitted. Plus, busy approvers often leave paperwork buried at the bottom of inboxes, delaying approval processes.

Automated invoice processing significantly speeds up the workflow.

In fact, AP automation can accelerate invoice processing time by 73%.

On top of this, 64% of organizations agree that AP approvals are quicker with automation.

It’s not just that automation cuts out repetitive tasks and reduces manual data entry. Automatic routing and approval notifications mean approvals get signed quicker, while automatic validation cuts out errors, removing the time spent on remedial work.

3. Reduce Errors in the Process

Manual AP processes are riddled with data entry errors, missing paperwork, duplicate invoices, and double payments.

Errors result in late or incorrect payments, as well as extra expenses to remedy issues. Inaccuracies in paperwork can also cause compliance problems.

Automation reduces errors by automatically validating data before it’s submitted.

Thanks to this capability, 36% of organizations agree that automation leads to fewer exceptions and duplicates in the AP process.

What’s more, 30% of organizations say AP automation helps improve compliance.

4. Cut Back on Costs

Manual AP processes are costly.

Not only are they slow and cumbersome, requiring lots of staff and manual labor hours, they’re also error-prone. These errors lead to extra remedial costs.

Plus, delays in the process often lead to late payment costs, which mean that companies miss out on an early payment discount.

On top of that, manual processes require overheads for processing, such as paper, printer ink, and filing system supplies.

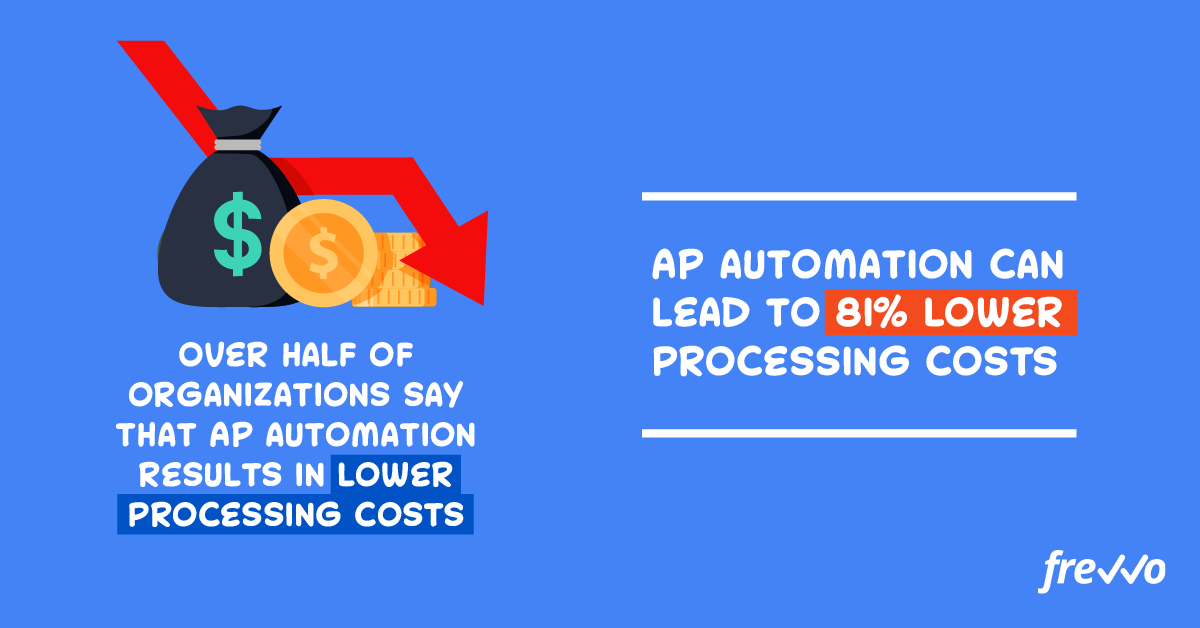

Over half of organizations say that AP automation results in lower processing costs.

In fact, these costs are significantly lower — AP automation can lead to an 81% reduction in invoice processing costs.

By implementing an AP automation solution like frevvo your AP process is faster and more scalable, meaning you need to pay fewer staff to do the same work.

On top of that, there are fewer remedial costs as data is automatically validated, cutting out mistakes.

Due to this, over a third of organizations say they experience fewer costs from late payments when using AP automation, while a quarter say automation makes it easier to capture the early payment discount.

5. Improve Supplier Relationships

As manual AP processes are slow, error-prone, and susceptible to frequent delays, they can compromise your supplier relationships.

Suppliers want fast payment, and you want your goods and services on time.

When paperwork is accurate, and AP processes are swift, this is possible. Unfortunately, manual AP processes don’t lend themselves to doing this well.

By switching to intelligent automation solutions for accounts processes, you can initiate faster payments that execute on time.

Plus, you’ll have a better audit trail for suppliers to increase transparency.

That’s why 28% of organizations agree that accounts payable workflow automation improves supplier relationships.

How to Automate AP Processes

There’s no need to keep struggling with manual AP processes. It’s simple to switch to frevvo’s no-code software to streamline your accounts payable system for faster, cheaper processing.

1. Pick a Pre-Built Accounts Payable Workflow Template

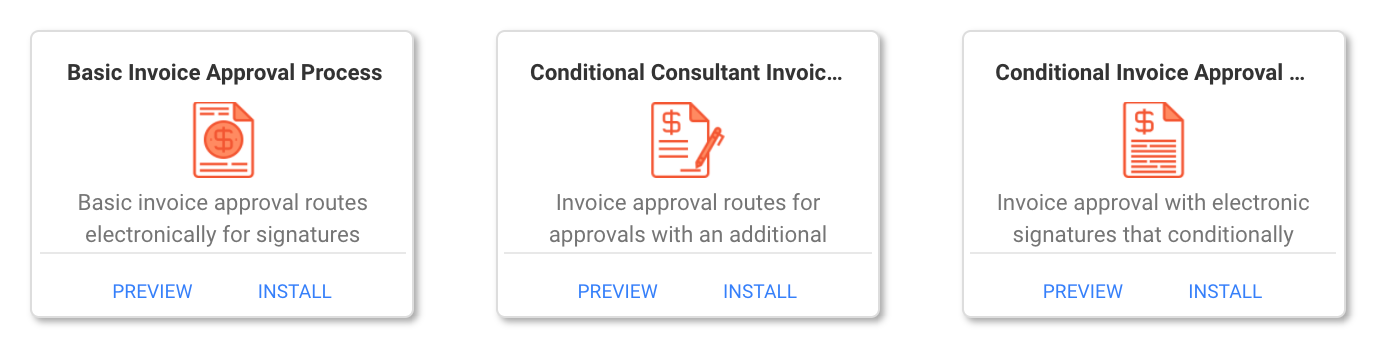

While you can build your own accounts payable workflow from scratch on frevvo, there’s also a library of pre-built templates to make the process easier.

Select the basic invoice approval if you have no need for conditional routing.

If you need to route your invoice to extra approvers based on the amount in the invoice, select the conditional routing template.

2. Customize Your Accounts Payable Workflow

Next, customize your accounts payable workflow to route automatically based on your AP process.

You can add and remove steps in the process, as well as edit each stage to suit your internal policies.

For example, you can edit the messaging of the email sent to suppliers to let them know their invoice has been approved, and adjust the invoice amount required for conditional routing to a VP.

At this stage, you can assign approvers by role or individually. You can also set escalations that trigger when an approval hasn’t been attended to.

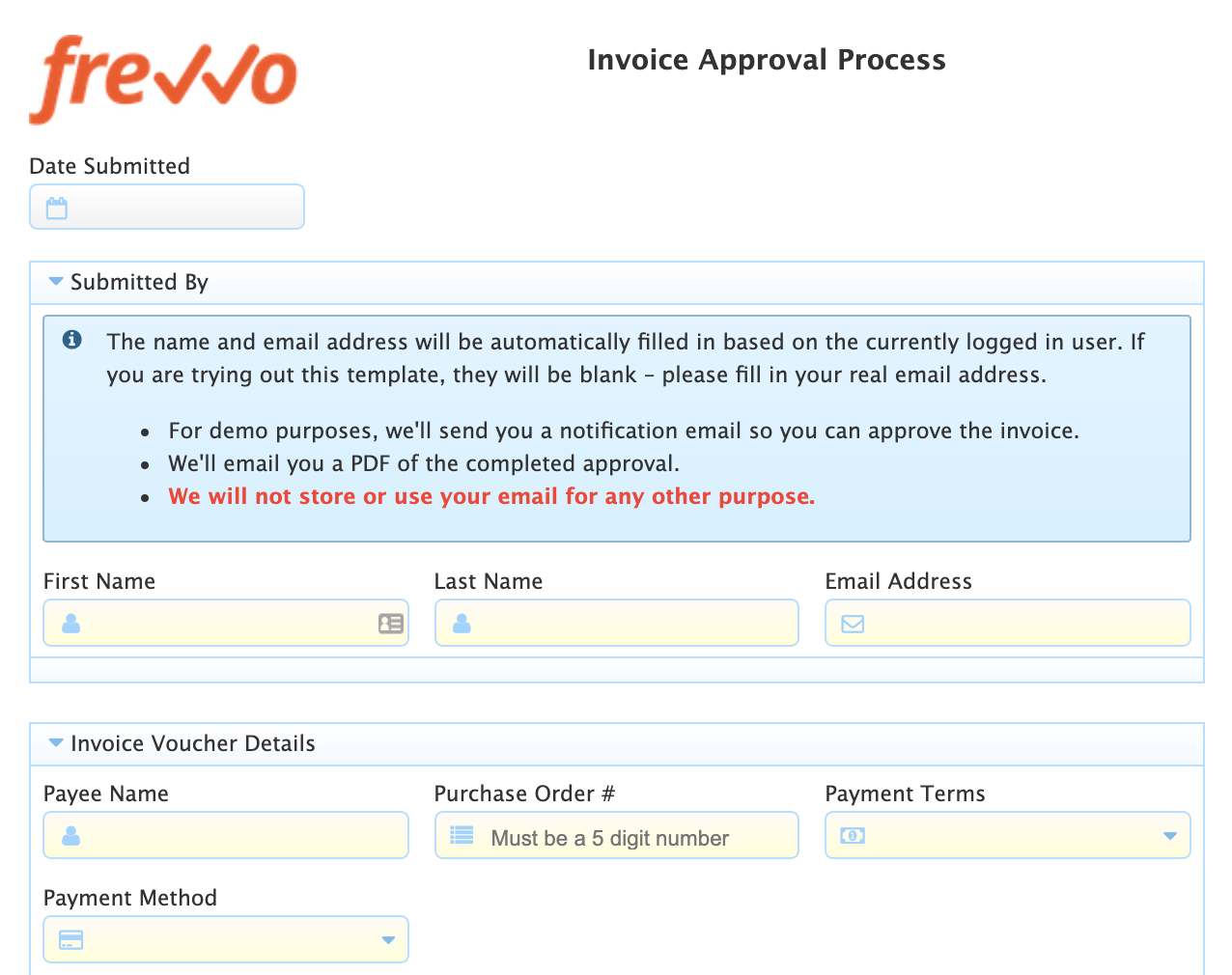

3. Create AP Approval Forms

Create digital forms for your invoice approval process.

You can customize the template form using the drag-and-drop editor in the dynamic form builder, or you can create your own digital form from scratch.

When this form is connected to your SQL database via the Database Connector, it will automatically populate with key data to reduce manual data entry.

Don’t forget to add relevant instructions to each section of the form.

Adjust business rules to program the form’s dynamic behavior. For example, you can set the form to calculate payments automatically.

4. Generate Dynamic PDFs

Create dynamic, editable PDFs from your forms or add your own templates.

These PDFs can be sent to your supplier automatically for record-keeping to ensure a complete, accurate audit trail.

You can also save these PDFs directly to your system. They’re especially useful if you’re using Google Apps for record-keeping.

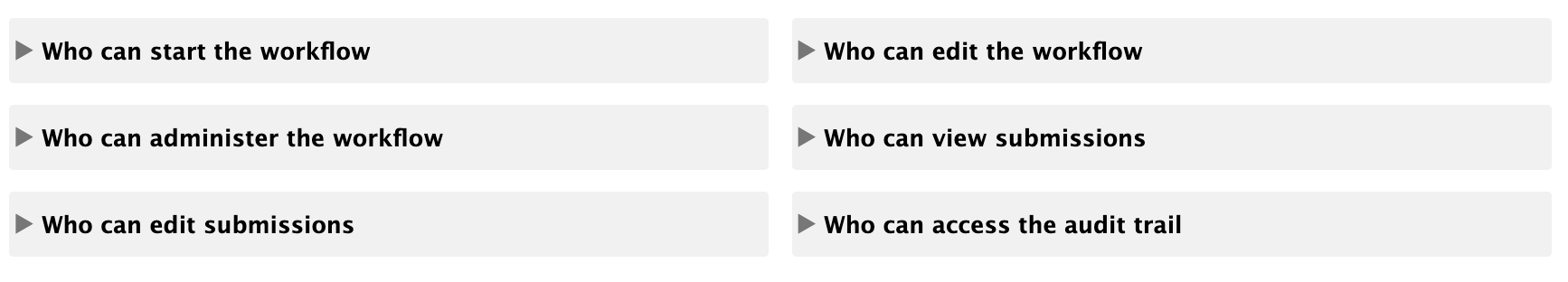

5. Set Access Controls

Set access for your accounts payable workflow to prevent fraud.

By limiting access, you restrict who can edit data, providing a better level of accountability.

Use the Settings to adjust who can initiate and carry out the workflow, as well as who can edit and view submissions. You can also set access so that only certain people can edit the workflow and audit trail.

6. Integrate with Record-Keeping Software

Integrate your AP workflow with your accounting software to automate record-keeping. This ensures you have a complete, accurate audit trail at all times.

While your audit trail will automatically save to frevvo’s built-in repository, you can also integrate Google Apps, SharePoint, and many other financial systems.

Built-in insight reporting also helps you to keep track of payments and identify any common bottlenecks in the process.

Conclusion

There are plenty of accounts payable automation examples that model the benefits of automating your AP process. Why not switch over to take full advantage of these benefits?

With faster AP processing, lower costs, and fewer errors, AP automation helps you to build stronger supplier relationships and tackle fraud head-on.

Ready to try it yourself? Give frevvo a go — sign up for the free trial today.