It’s not just that manual invoice processes are slow and cumbersome — they also create a greater risk of fraud.

When paperwork is filled in manually, and approvals are sought by hand, it’s easy for fraudulent activity to go undetected.

Invoice automation is a great way to combat this since it minimizes the human element of the process. Plus, it accelerates invoicing workflows, cuts out errors, and reduces processing costs.

Read on to learn all about invoice automation, how it can benefit your organization, and how to implement it today.

Click the links below to head straight to the section which interests you most:

- What’s Invoice Automation?

- What Are the Benefits of Invoice Automation?

- 8 Ways to Automate Your Invoice Processes

- Example of Invoice Automation in Action

What’s Invoice Automation?

Invoice automation uses workflow automation software to automate manual invoice processing to increase efficiency and effectiveness.

Invoice processes are a vital part of a company’s procure-to-pay workflow.

When sellers or employees raise an invoice, they create and submit a commercial document to request payment for goods and services. Depending on your process, this may happen before or after services have been provided.

An invoice will outline what goods and services have or will be provided and how much they cost.

Invoice processing refers to all the activities your organization completes to receive, deal with, approve, and record this payment.

The workflow, which is usually handled by the accounts payable (AP) team, starts when the invoice is received and ends once it’s been paid and filed to records.

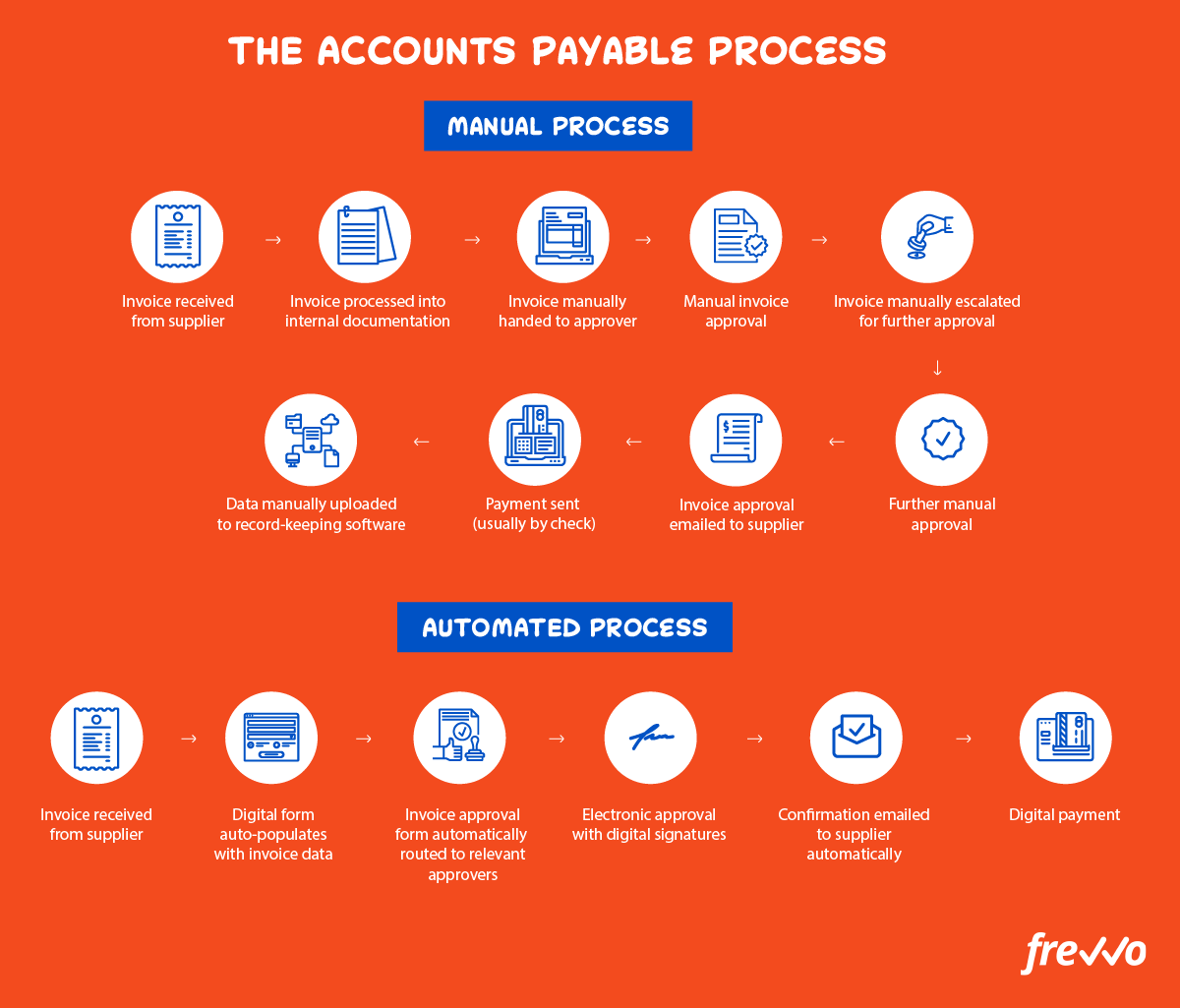

Traditionally, processing has been done manually. Manual processing usually looks something like this:

- Receive invoice

- Manually verify invoice details by matching them to a PO and/or receipt

- Record invoice in internal financial system with manual data entry

- Give invoice to the approver by hand

- Approve invoice by hand

- Update supplier that the invoice was approved for payment

- Pay the invoice manually (e.g. issue a paper cheque and mail it)

- File all paperwork

Not only do half of all organizations admit that their manual process is inefficient, but manual workflows are also prone to error and vulnerable to fraud. In fact, 16% of organizations confess that they’ve had fraud issues associated with manual invoicing.

Automated invoicing removes many of these vulnerable steps and curtails human intervention to reduce susceptibility to error and fraud. Plus, it’s much faster.

Automated invoice processing looks more like this:

- The digital invoice is received from a supplier

- Invoice is automatically routed through the invoice approval workflow

- Confirmation of approval is sent to the supplier automatically

- Payments are made digitally

What Are the Benefits of Invoice Automation?

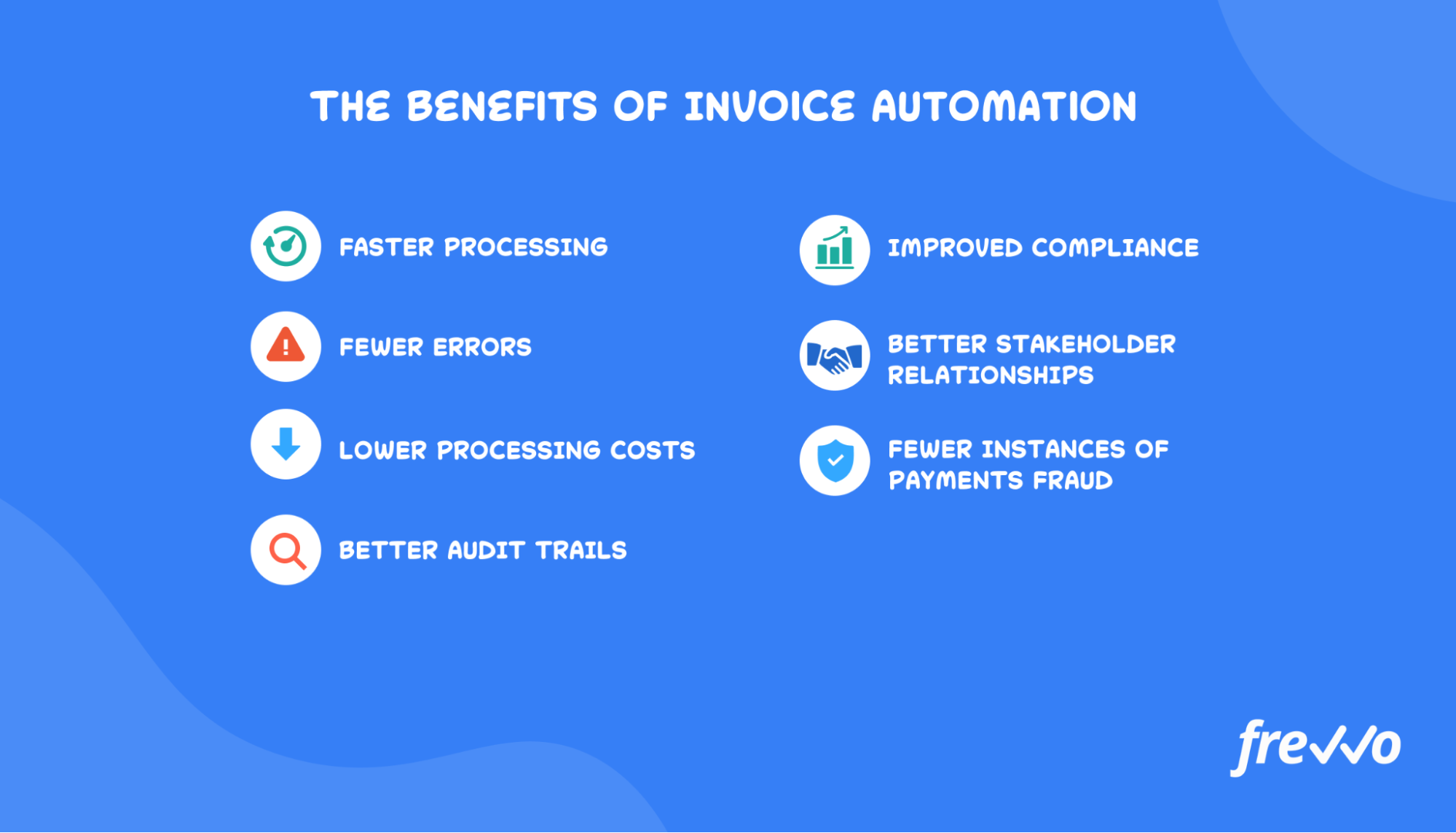

Invoice automation software like frevvo can speed up the accounts payable process, reduce fraud vulnerability, and lower costs.

Here are seven of the top benefits of implementing an invoice automation solution.

1. Quicker Processing

Conventional practices for processing invoices mean the workflow is slow. This is usually due to the tediousness of manual data entry and delays caused by errors.

When humans have to fill out forms by hand or enter data into Excel spreadsheets, it takes a lot of time and frequently results in typos and mistakes.

Plus, there are often delays in the invoice approval process where approvers don’t get around to signing a document, or it gets buried under paperwork on a busy manager’s desk.

An automated process is far quicker. In fact, an AP automation solution can speed up the workflow by 73%.

Automation of data entry cuts out repetitive tasks and accelerates processing. Automatic validation of incoming invoices verifies data to reduce error-related delays. According to 64% of organizations, automated routing and automatic approval notifications expedite the approval process.

2. Fewer Errors

A manual invoice workflow is error-prone.

Not only are you at risk of mistakes from manual data entry, but there’s also a high chance of a paper invoice going missing, duplicate invoices being produced, and discrepancies between invoices and purchase orders.

A third of companies admit that they have problems with lost or missing documents in the invoice process, while a quarter of businesses confess to duplicate invoice and payment issues. Another quarter says that they experience discrepancies in the paper trail.

These obstacles lead to late and incorrect payments, compliance issues, and extra expenses to remedy the problems.

Invoice processing automation solutions automatically validate data to prevent errors from blocking the pipeline later and causing these headaches.

3. Lower Processing Costs

Manual invoice processes are expensive because data entry takes a long time, resulting in high labor hours. Not only that, but continuous errors mean that the staff has to spend more time rectifying problems, leading to even higher labor costs.

Plus, delays in the pipeline mean you’ll miss out on early discounts. It can also result in fines for late payments.

On top of the cost of staffing, businesses have to fork over costs for office supplies and document storage.

Accounts payable automation can lower the cost of processing invoices by up to 81%.

What’s more, a third say they experience fewer costs from late payments, while a quarter agree that automation allows them to take advantage of early discounts.

4. Better Audit Trails

Manual record-keeping can be tricky.

Not only does manual data entry take a long time, but when the staff forgets to update records or files away documents with errors, it can lead to compliance issues down the line.

Plus, storing paper documents can be extremely expensive and takes up a lot of space.

Part of an automated invoice process is automatic record-keeping.

By switching to electronic invoicing, AP automation software can validate that invoice information is correct when submitted. Once invoices are processed, they’re automatically uploaded to the digital system, so audit trails are always complete, correct, and up-to-date.

5. Fully Compliant

30% of companies agree that invoice processing automation helps with compliance.

Where manual invoices are so prone to mistakes, audit trails are usually full of errors. Plus, the tediousness of manual data entry often means that staff forgets to keep records up-to-date. Both of these things result in your business being non-compliant.

Since automatic invoice workflows validate data and update records automatically, you’re always fully compliant.

6. Enhanced Stakeholder Relationships

Manual invoice processes are vulnerable to delays and lost paperwork, so suppliers and vendors often have to submit repeat documents or wait longer than planned to get paid.

This upsets your relationship with these stakeholders.

Automating these processes cuts out delays and obstacles, which strengthens relationships with your stakeholders. Nearly a third of companies agree that automating invoice processes boosts supplier relationships.

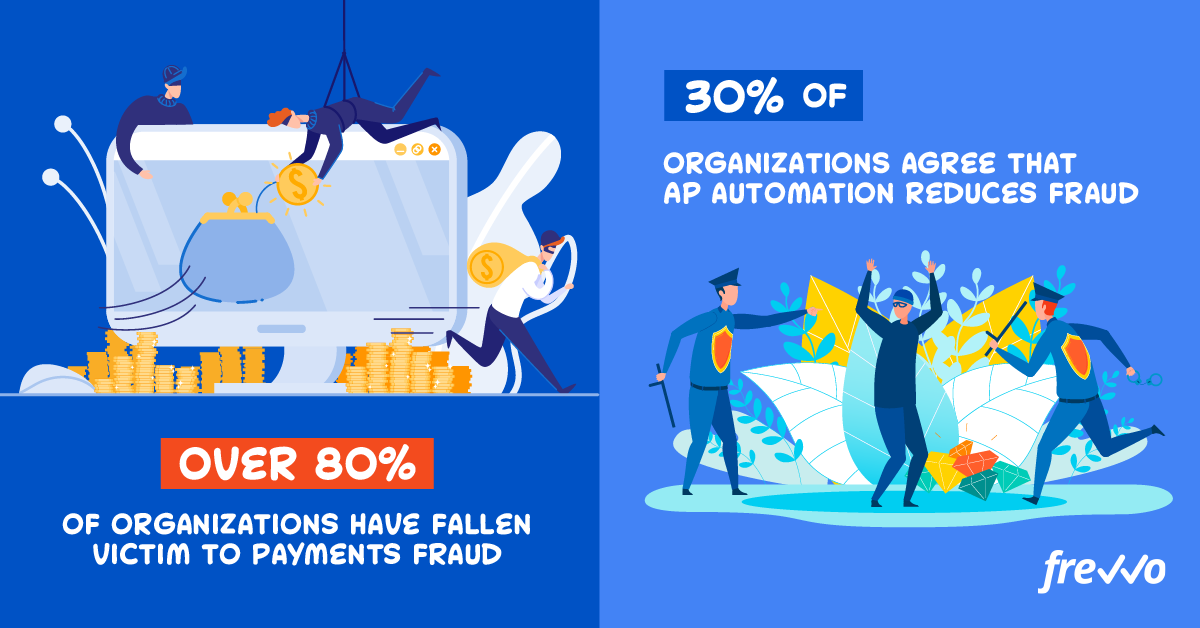

7. Less Accounts Payable Fraud

Accounts payable fraud is more common than most companies realize. A fifth of organizations experience procurement fraud, while almost a third of companies are victims of accounting fraud. Over 80% have experienced payments fraud.

This is because manual accounting processes are easy to manipulate. Half of all reported losses of over $100 million were due to fraudulent activity by someone inside the company.

Automation makes it harder for fraud to occur as it cuts out the human element where data can be manipulated. Calculations are automated, data is automatically validated, and a digital audit trail helps improve accountability.

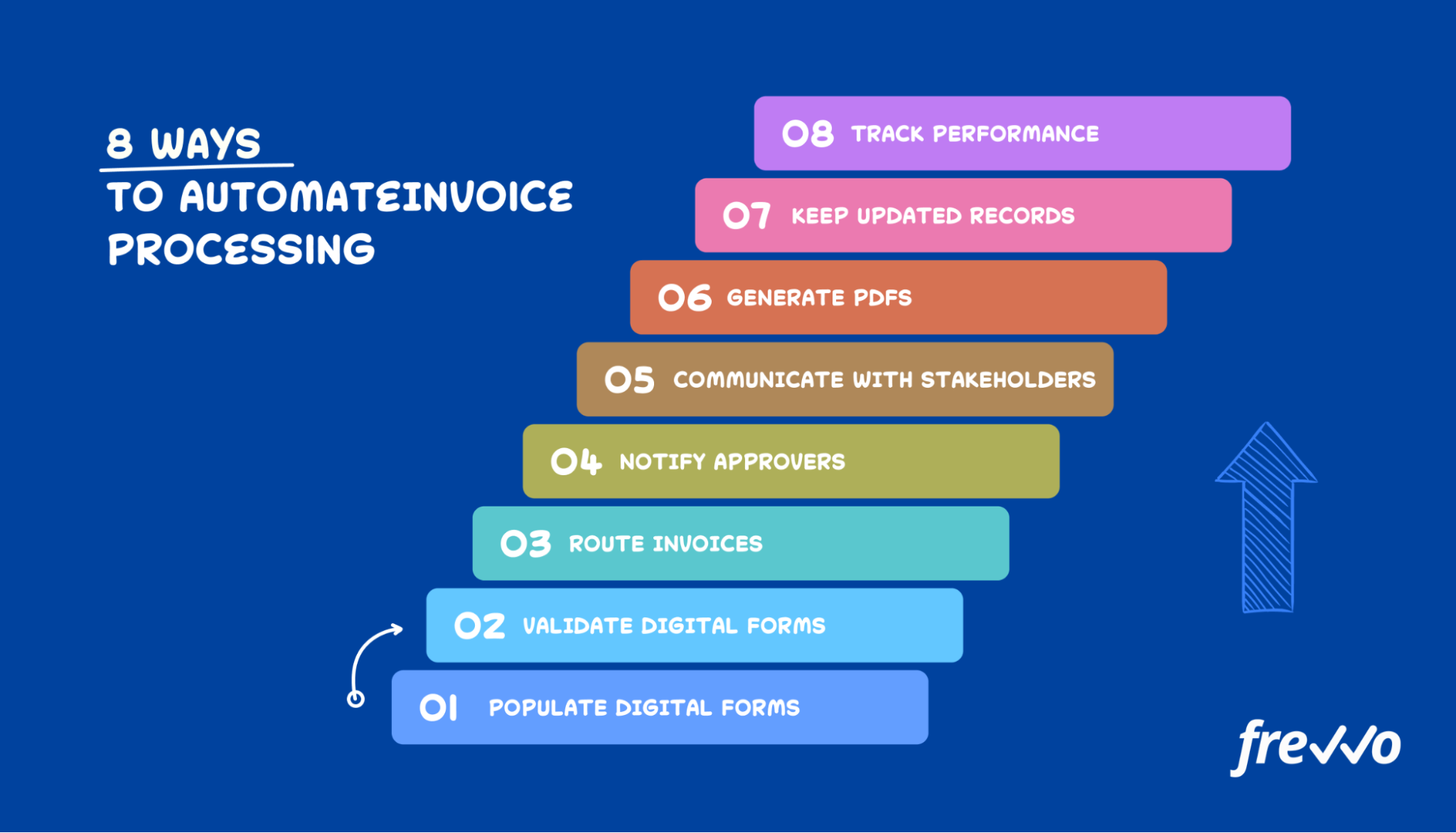

8 Ways Invoice Automation Software Improves Your Invoice Processes

Invoice automation software like frevvo is the ideal solution to automate your accounts payable workflow.

Here’s how to automate the different stages of your invoice process.

1. Populate Digital Invoices

Entering data can be one of the most inefficient aspects of a manual workflow. Not only is it slow and labor-heavy, but it’s also easy to make mistakes.

With frevvo, you can connect your financial systems and SQL databases to pull relevant information into your digital forms. That way, you can save time filling out forms by automatically populating them using the data that already exists in your other systems, such as contact information, goods and services descriptions, and costs.

What’s more, you can program your digital forms to show only relevant information to each stakeholder as the form routes through the process.

For example, a supplier filling in the form will only see the fields they need to fill in, while an approver later down the line will have a box to sign the document electronically.

2. Validate Digital Invoices

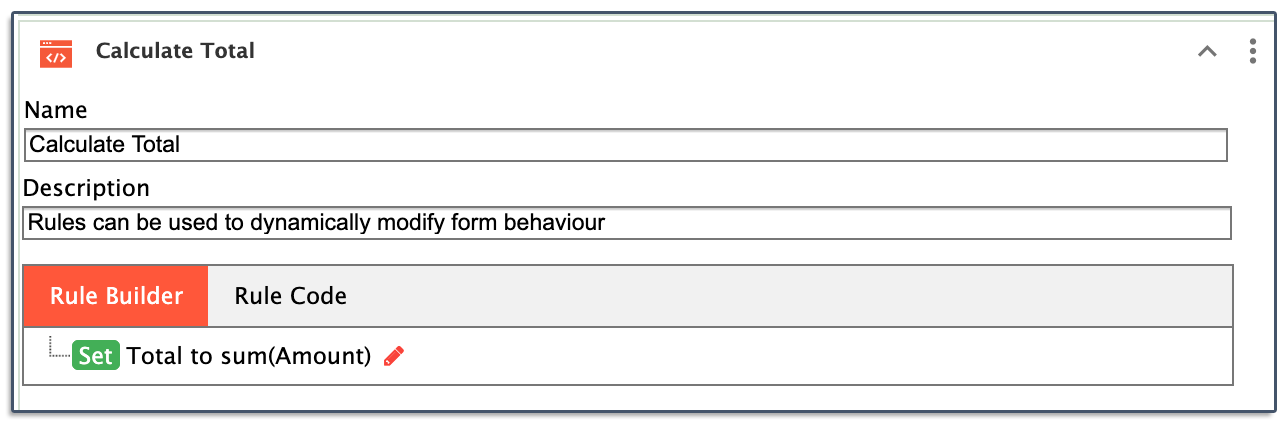

Avoiding the inaccuracies associated with manual data entry, invoice automation software will automatically validate the information in your digital invoices to ensure it’s correct. If the information isn’t right, you can’t move to the next stage of the process.

The software will validate personal data and information about goods and ensure that calculations are correct.

This prevents incorrect data from entering the workflow, avoiding delays and compliance issues further down the line.

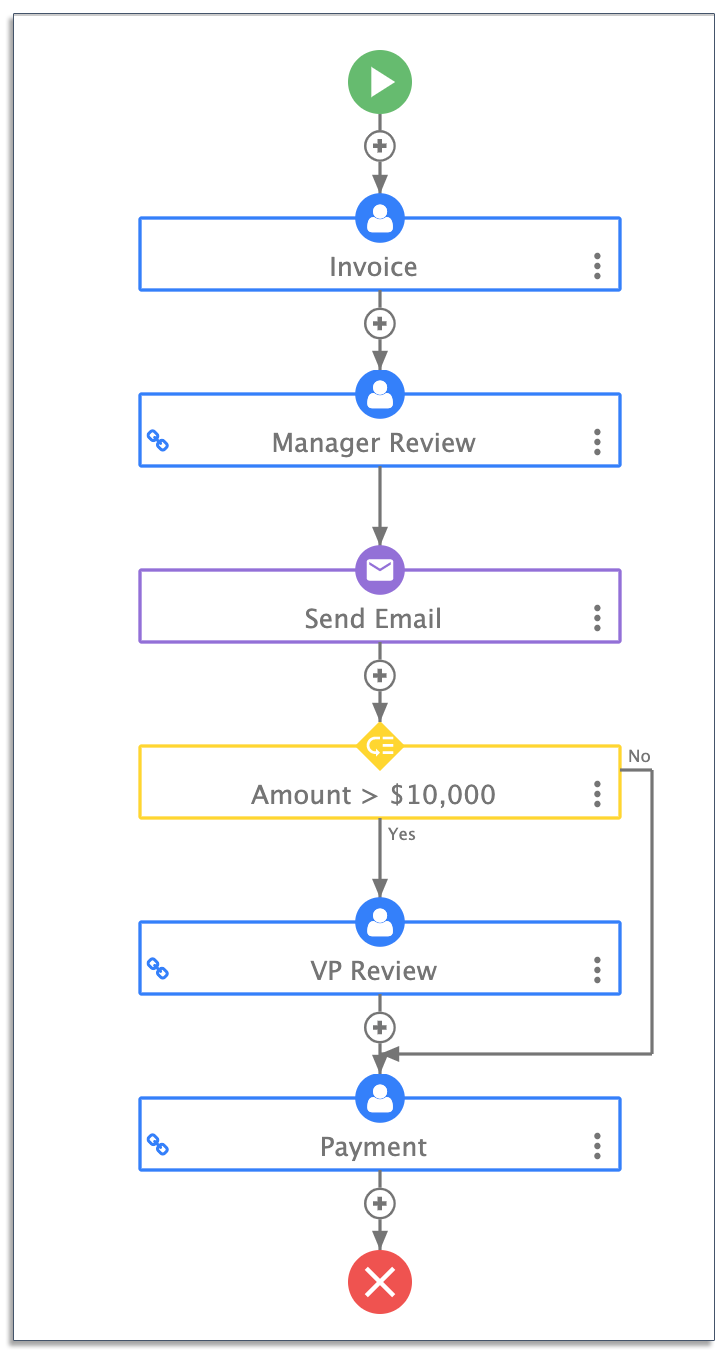

3. Route Invoices

In manual invoice workflows, invoices must be sent via email or moved through the pipeline by hand. This often leads to misplaced paperwork and delays. That’s why 37% of finance departments agree that manual invoice routing is their biggest pain point.

Automation invoice solutions like frevvo electronically route your invoices through the pipeline based on dynamic business rules without the need for humans to forward emails or figure out approver chains.

Not only can you route forms through a simple workflow, but you can also create conditional routes that divert invoices to different stakeholders depending on the information in the forms.

4. Notify Approvers

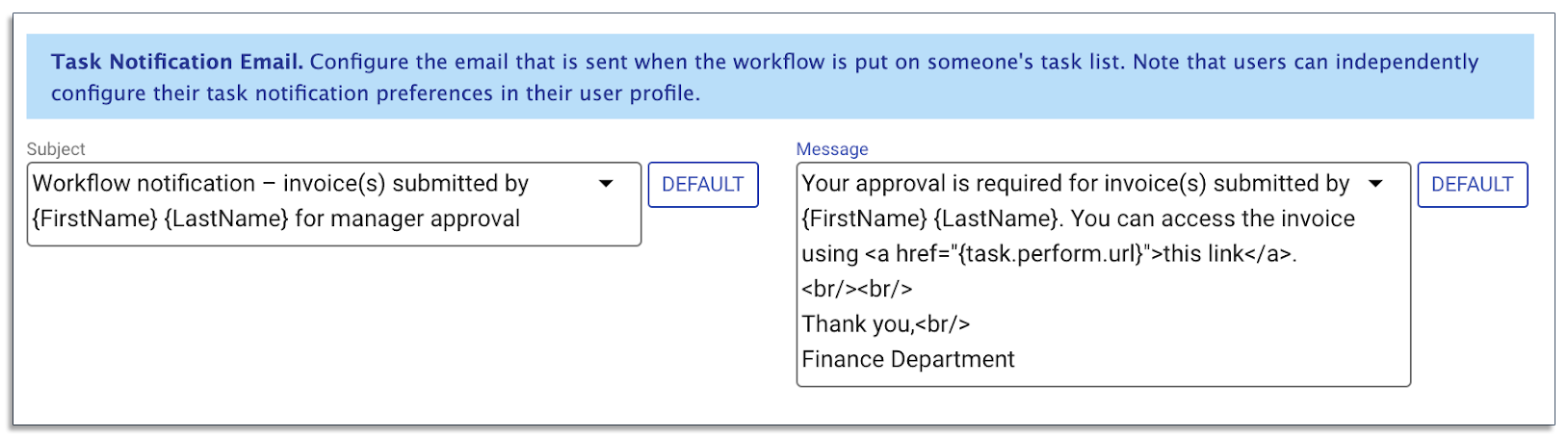

Instead of leaving invoices to sit on an approver’s desk, automated invoice software will notify approvers automatically, so they know that an invoice approval is pending.

Automatic notifications let approvers know that there are documents for them to sign electronically. If approvers fail to sign the documents on time, the system automatically sends reminders or escalates to a supervisor to prevent further delay.

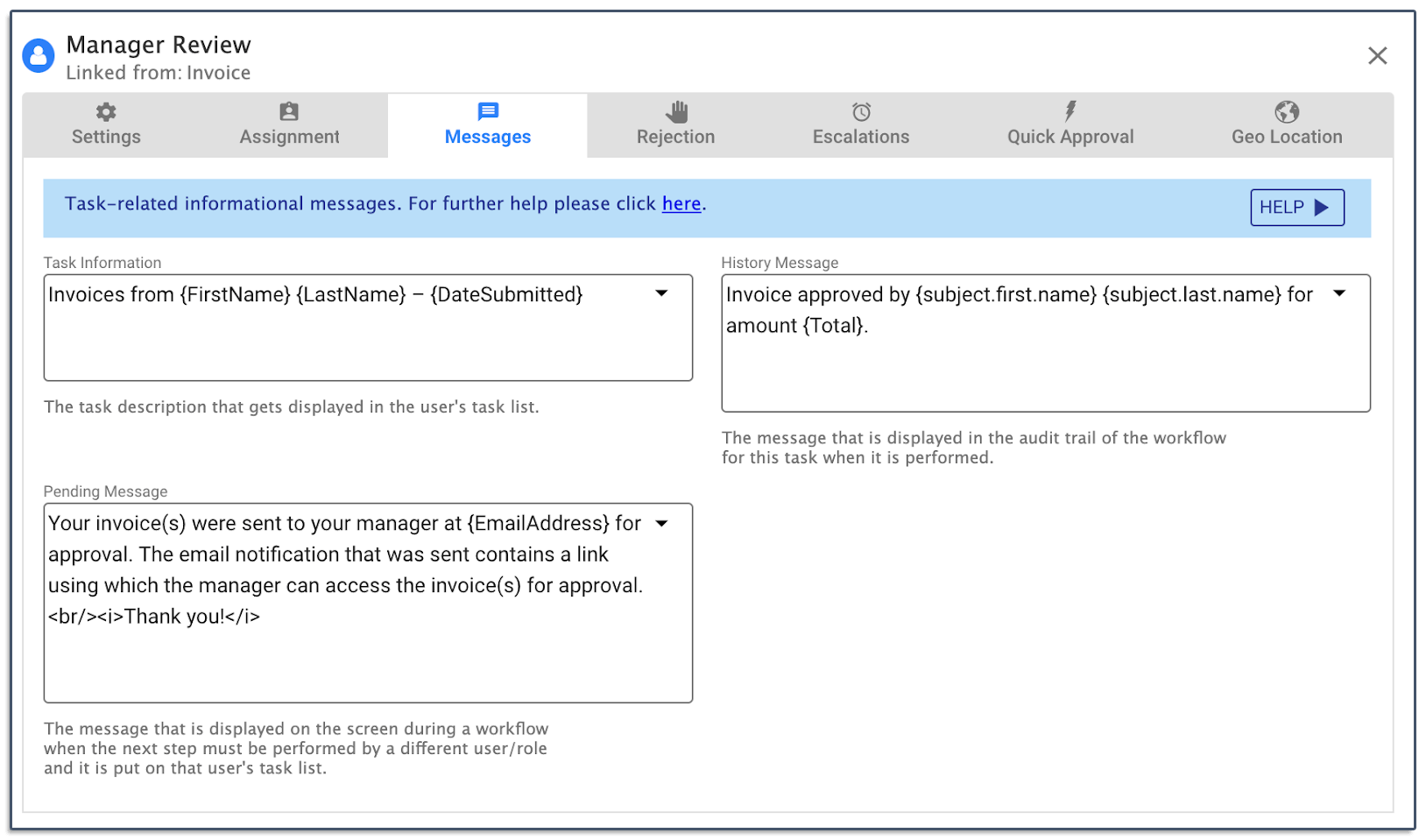

5. Communicate with Stakeholders

Transparency with stakeholders can help to build strong relationships. Communication is the key to this.

By automating your invoice process, you can set your software to send automatic messages directly to stakeholders and update them on the approval status of their invoices.

If they want, suppliers can also electronically check on the status of an invoice at any time via a built-in audit trail.

6. Generate PDF Documentation

Automated invoice tools like frevvo allow you to automatically generate PDF documents to upload to your systems, thus helping you keep more complete records.

You can also send these PDFs directly to stakeholders so that they have a copy to keep for their records.

You can automatically generate PDFs from the information within your digital forms or electronically transfer form data to your own custom PDFs to conform to business standards.

Generated PDF documents also incorporate digital signatures so approvals are also properly recorded.

7. Record-keeping

To keep your invoice process compliant at all times, you need to make sure your records are kept up to date.

Integrate your automated invoice workflow with the record-keeping system that suits you.

When using frevvo, you can integrate most document management systems, SharePoint, Google Drive, and many other financial systems so that all documentation is automatically updated. Invoice documents and supporting attachments are automatically saved and indexed for future retrieval.

frevvo also has its own built-in repository for storing documentation if this suits your company better.

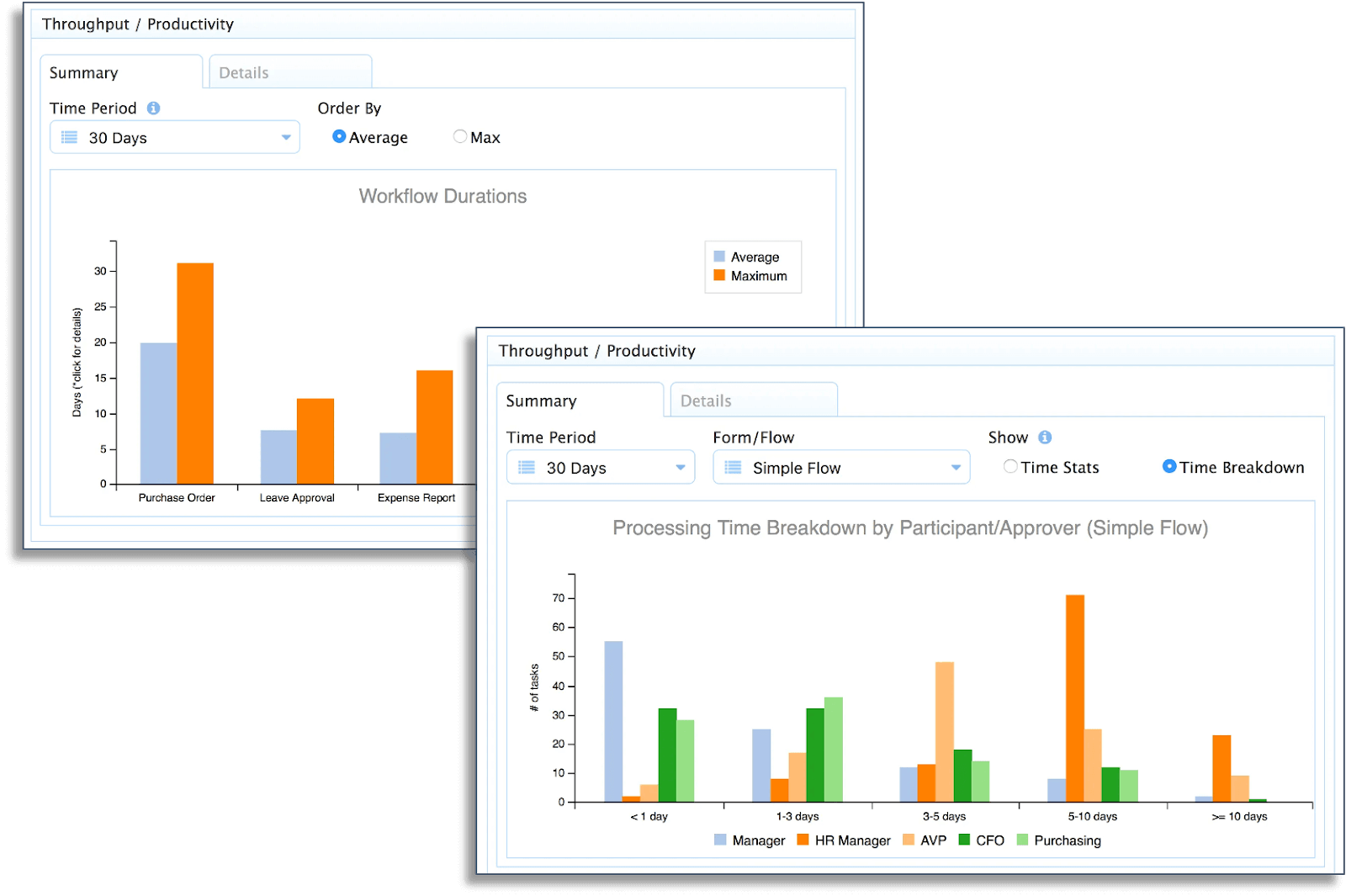

8. Track Performance

To ensure that your invoice processes are performing to maximum efficiency, you’ll want to track your workflows.

Using frevvo’s built-in reporting system and workflow analysis dashboard, you can track the speed and effectiveness of the invoice process to identify any bottlenecks that are slowing it down or causing delays.

This system also helps you monitor payments so that you don’t lose track of outstanding invoices.

Example of Invoice Automation in Action

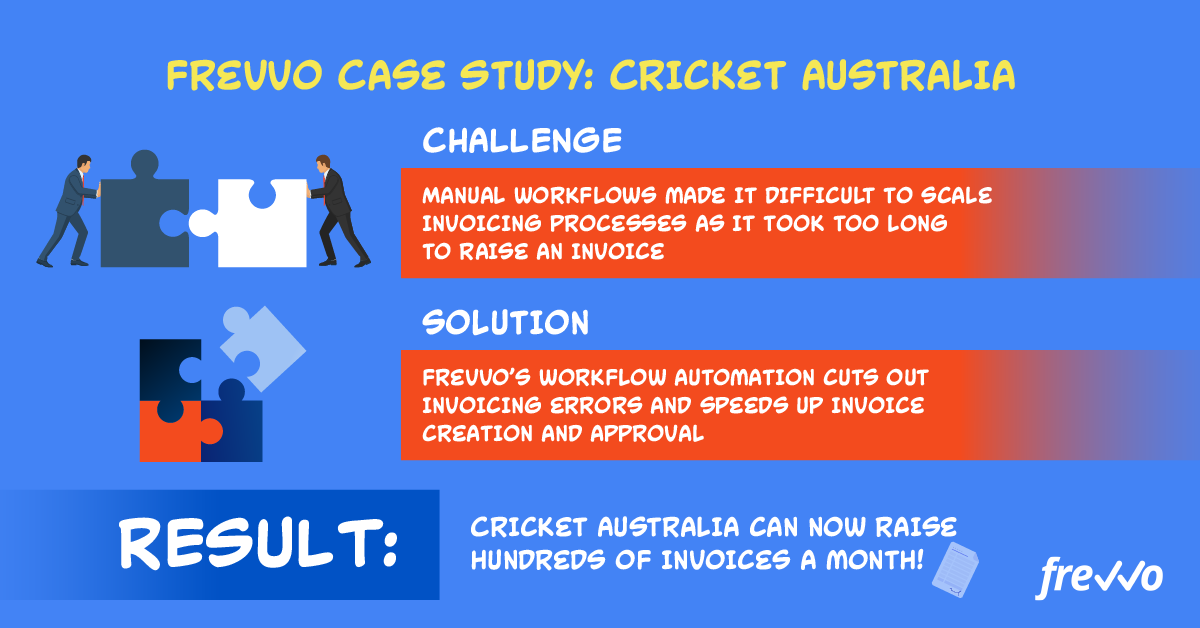

Cricket Australia offers one of the best accounts payable automation examples.

Before implementing frevvo, Cricket Australia was suffering from very slow invoice processes because the tool they were using was outdated and clunky, requiring lots of manual steps.

There was a lot of back-and-forth to check data and get invoices approved, which caused serious delays.

By switching to frevvo, Cricket Australia has cut its invoice turnaround time by 50%.

Invoices are now sent digitally and are automatically routed to the right approvers and stakeholders who can sign these documents online.

Not only is this far quicker and easier, but Cricket Australia is also now able to successfully process hundreds of invoices every month while freeing up staff time for more productive tasks.

Automate Your Invoice Processes Today

It’s not just that manual invoice processes are slow, cumbersome, and costly. They’re also vulnerable to accounts payable fraud.

Automating your invoice processes removes the human element, which accelerates the workflow, protects against thieves, and helps you achieve operational excellence.

frevvo makes it easy to switch to automatic invoice processing thanks to its easy low-code software. Try frevvo’s free trial today to see just how simple automating your invoice processing can be.